How to Design a Rewards Program

Crafting effective rewards strategy avoiding pitfalls, enhancing engagement, and ensuring long-term success.

Rewards, in some sense or form, have always been part of our lives, seamlessly woven into the fabric of our everyday interactions. They're the little nudges, the carrots dangled in front of us, pushing us toward certain behaviors or accomplishments.

Think back to your childhood. Remember that shiny new bicycle you desperately wanted? Your parents probably turned it into a motivational tool, dangling it like a carrot on a stick, promising it to you if you aced your final exams. Classic parental psychology at play!

Or consider a visit to a temple. Ever wondered why prasad is offered? It’s not just about the sweets; it's a spiritual reward, a way to signify blessings and encourage devotional behavior.

Now, picture a dog trainer armed with treats. Each time the pup sits or rolls over, a treat is swiftly dispensed. It’s a simple, effective way to teach new tricks. The dog knows: perform the trick, get the treat. Easy peasy!

And then there are those high-flying bankers, consultants, and salespeople. Ever noticed how their salaries often have a hefty bonus component? That’s no accident. The promise of a fat bonus check is a powerful motivator, driving them to close deals, hit targets, and push boundaries.

These are all examples of reward systems in action, cleverly designed to elicit specific behaviors from the rewarded individual. From parents to spiritual practices, dog trainers to corporate giants, rewards are the universal currency of motivation.

Table of Contents

How to Approach Devising a Rewards Program: A Practical Guide

Practical Example: How we implemented our Rewards program at Flobiz

What Are Rewards? The Secret Sauce to Behavioural Magic

Rewards are essentially stimuli used to elicit desired behaviors or habits, ensuring those actions are encouraged and reinforced.

To understand why this works, let's dissect some key concepts like habits and behaviours, and delve into how our brain functions.

Into the Human Brain

Consider the following excerpt from Atomic Habits which explains this beautifully

“A habit is a behavior repeated enough times to become automatic. Habit formation starts with trial and error. When you encounter a new situation, your brain must decide how to respond. Initially, you're unsure of the solution, similar to Thorndike’s cat trying random actions to escape a box.

During this trial period, neurological activity in the brain is high. You're analyzing the situation and making conscious decisions. Your brain is busy learning the most effective course of action.

Occasionally, like a cat pressing a lever, you stumble upon a solution. You feel anxious and discover that running calms you. You’re exhausted and find that playing video games relaxes you. You're experimenting until—BAM—a reward.

After experiencing an unexpected reward, your brain catalogs the event for future use.”

We can reverse-engineer this process to hack the brain and teach specific behaviors.

The Habit Loop: Your Brain’s Playbook

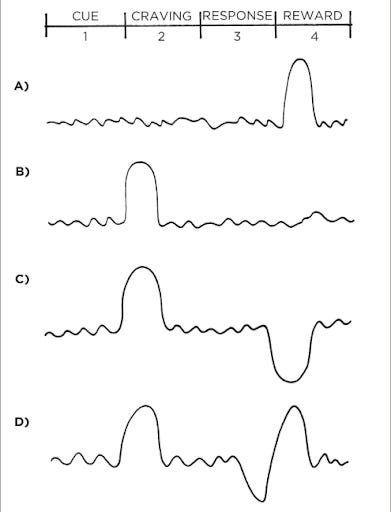

The process of building a habit can be divided into four steps: cue, craving, response, and reward.

Cue: This triggers your brain to initiate a behavior, predicting a reward.

Craving: The motivational force behind every habit, linked to a desire to change your internal state.

Response: The actual habit you perform, whether a thought or an action.

Reward: The end goal of every habit. The cue is about noticing the reward, the craving is about wanting it, the response is about obtaining it. Rewards satisfy your craving and teach you which actions are worth remembering.

Dopamine Dynamics: The Brain’s Reward Rollercoaster

Before a habit is learned:

Dopamine is released when the reward is experienced for the first time.

The next time, dopamine rises before taking action, almost in anticipation of receiving a reward, creating a craving when the cue is recognized.

Once a habit is learned, dopamine doesn’t rise with the reward because it's expected. If the expected reward doesn’t come, dopamine drops in disappointment.

If the reward is delayed, dopamine initially spikes with the cue, drops when the reward is delayed, and spikes again once the reward is received, reinforcing the behavior.

In essence, our brain’s reward system is a powerful tool for forming habits. By understanding and leveraging this system, we can design rewards that effectively elicit desired behaviours.

Fun Fact: The TikTok Temptation

Ever wonder why short-form videos on platforms like TikTok are so wildly addictive? It all comes down to the habit loop and dopamine dynamics. Each video acts as a quick cue, triggering a craving for entertainment or distraction. The immediate response is to watch the video, and the reward is a burst of dopamine when you find something amusing or interesting. This rapid cycle of cue, craving, response, and reward happens in mere seconds, making it easy to watch video after video. The brain loves the quick hits of dopamine, which is why you can lose track of time scrolling through endless clips. It's a perfect example of how rewards can keep us hooked, reinforcing the behavior of seeking out more content.

Fun Fact 2: Casinos and Swipe up navigation

Even more fascinating is the swipe-up gesture, which is eerily similar to pulling the lever on a slot machine in a casino. This design is no accident. Casinos have perfected the art of keeping people engaged, using the lever pull as a cue that triggers anticipation and craving. TikTok and other social media platforms have adopted this mechanic, turning the simple swipe into an addictive action that keeps users hooked, constantly seeking the next dopamine hit.

Infact, one can find such patterns by just thinking and observing the world around. Do you know more such fun facts? Share it with us in the comments.

How does it all fit into business?

Now, you may be wondering how all this brain science fits into the business world, especially in tech. Well, most companies are in the business of changing human choices, behaviors, and habits, either implicitly or explicitly.

Changing Habits, One Reward at a Time

Remember when Milo used to offer cricket bats if you purchased their product a certain number of times? They weren't just being generous; they were trying to change our habit of drinking milk with another brand. By offering a desirable reward, they nudged consumers to choose Milo over competitors.

Collecting pokemon tazos (you got with Cheetos) would have been every 90s kid’s most cherished memories, PepsiCo wanted to change the behavior of snacking with that move.

Who doesn’t like to unwind and go bonkers on the free food at airport lounges.

Ever wondered why does your credit card company bear your food expenses at your visit to airports? Stick around till the end and you will be able to answer it for yourself..

And you could find countless such examples..

What businesses are trying to do here is either:

Get consumers to try something new

Alter consumer preferences by changing their consumption patterns

Solicit a repeat customer visit/ purchase

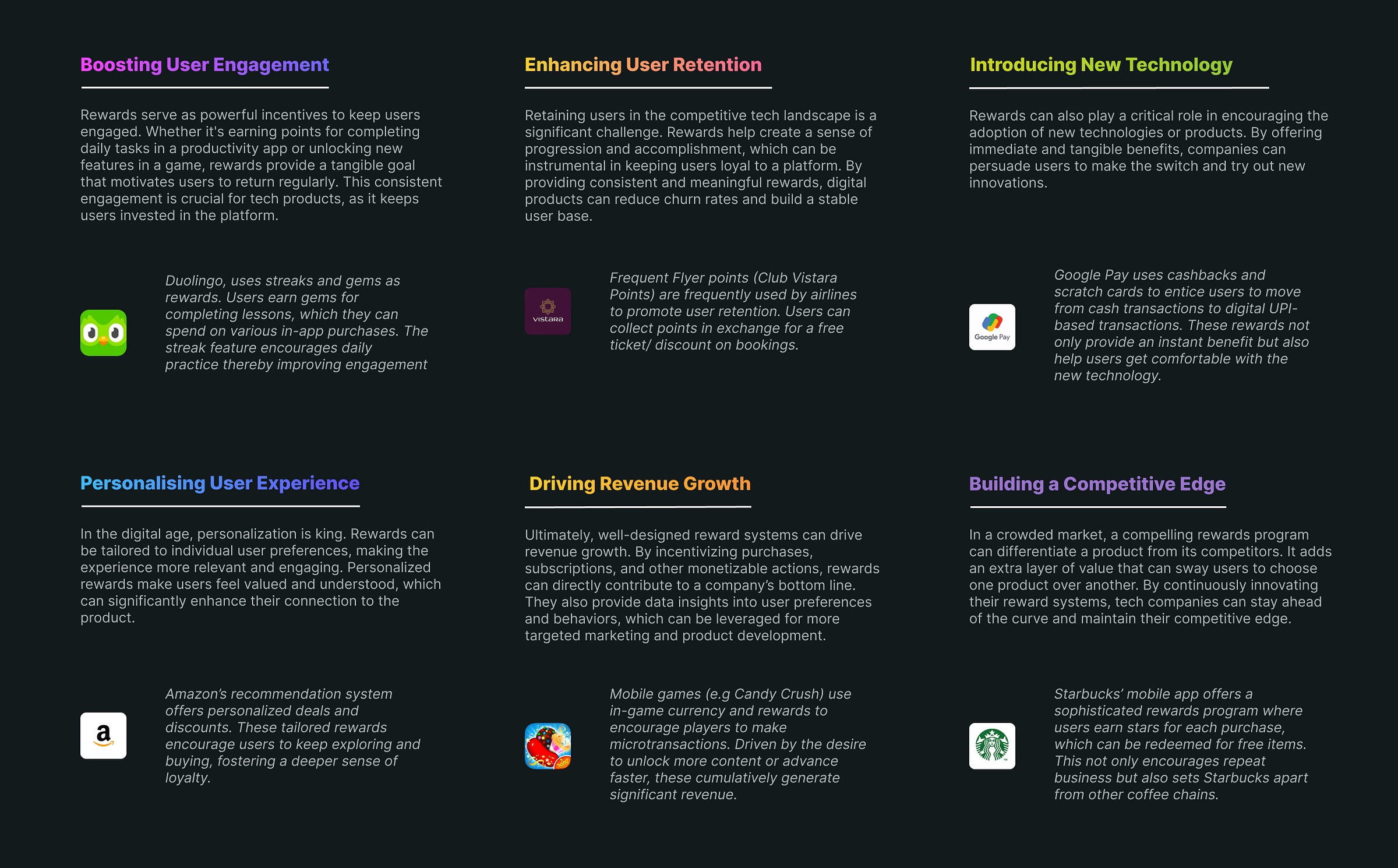

What Purpose Do Rewards Serve in the Tech and Digital Products Landscape?

In the fast-paced world of tech and digital products, rewards are not just nice-to-haves; they're essential tools that drive engagement, retention, and overall user satisfaction. Here's why:

In summary, rewards in the tech and digital products landscape serve multiple purposes: they boost engagement, enhance retention, encourage desired behaviors, personalize the user experience, drive revenue growth, and build a competitive edge. By leveraging the psychology of rewards, tech companies can create compelling user experiences that foster loyalty and long-term success.

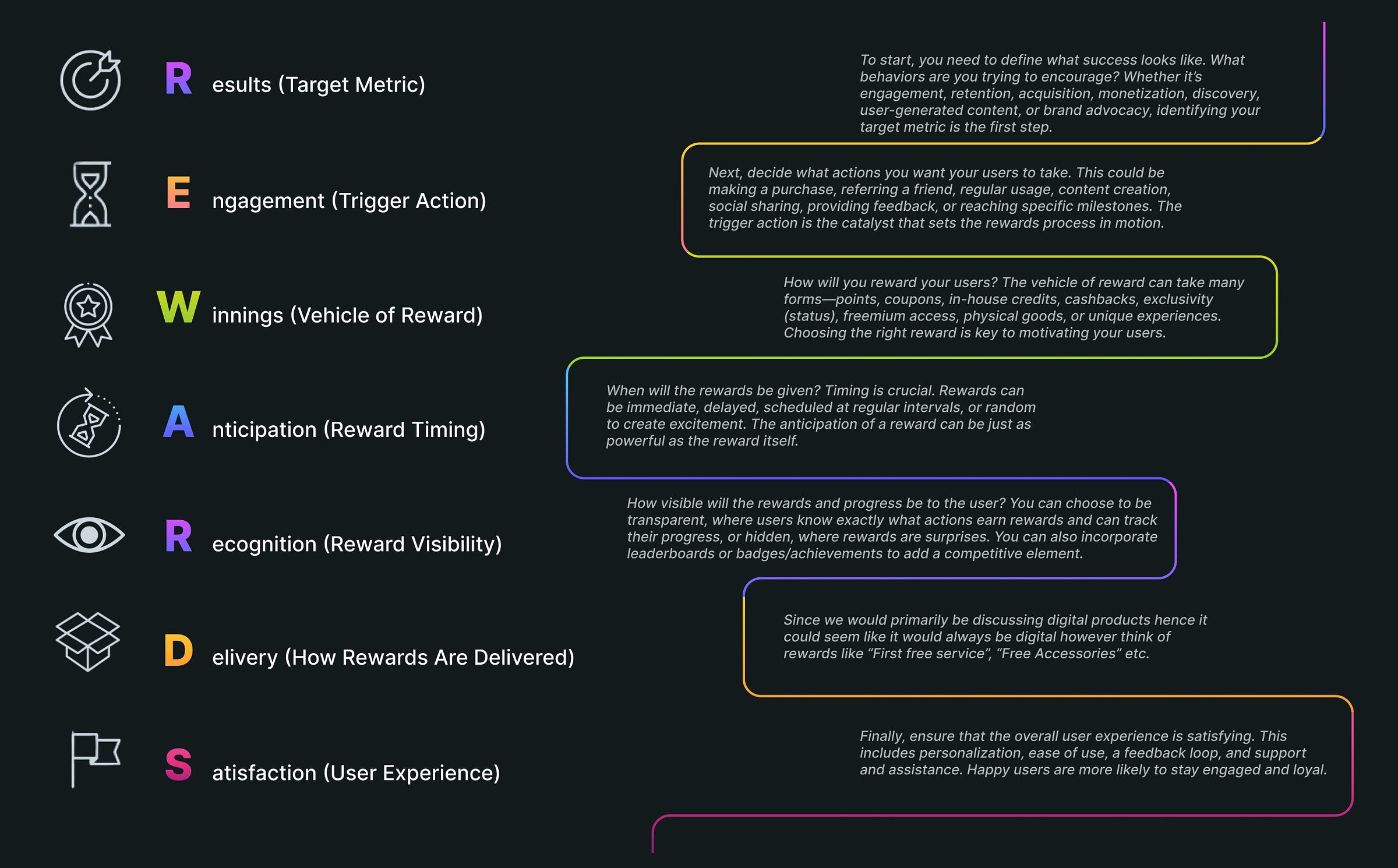

Building Blocks: How are rewards programs built?

Creating a successful rewards program is like mixing the perfect cocktail: you need the right ingredients in the right proportions. Enter the REWARDS framework—your go-to recipe for crafting engaging and effective rewards programs that hit all the right notes. Here’s how it works:

Here are some examples of how each of these blocks are implemented:

Winnings (Vehicle of Reward)

Credit Cards implement a little bit of everything here - they partner with lounges to form an exclusive club like priority pass or diners club, some purchases yield reward points while some may yield a coupon code of an associate brand

Anticipation (Reward Timing)

Cred masters this well - even if you have won a cashback they would masquerade it behind a wheel spin or a slot machine

Recognition (Reward Visibility)

Remember the rangoli stamps gimmick by Google Pay? Or how they have replicated game levels into their UI while representing cashbacks?

Delivery (How Rewards Are Delivered)

Since we would primarily be discussing digital products hence it could seem like it would always be digital however think of rewards like “First free service”, “Free Accessories” etc.

Satisfaction (User Experience)

The most recent example that comes to mind is Jupiter’s 3 in 1 card, where you can bias your card to provide rewards on different category of spend and adjust it as you go

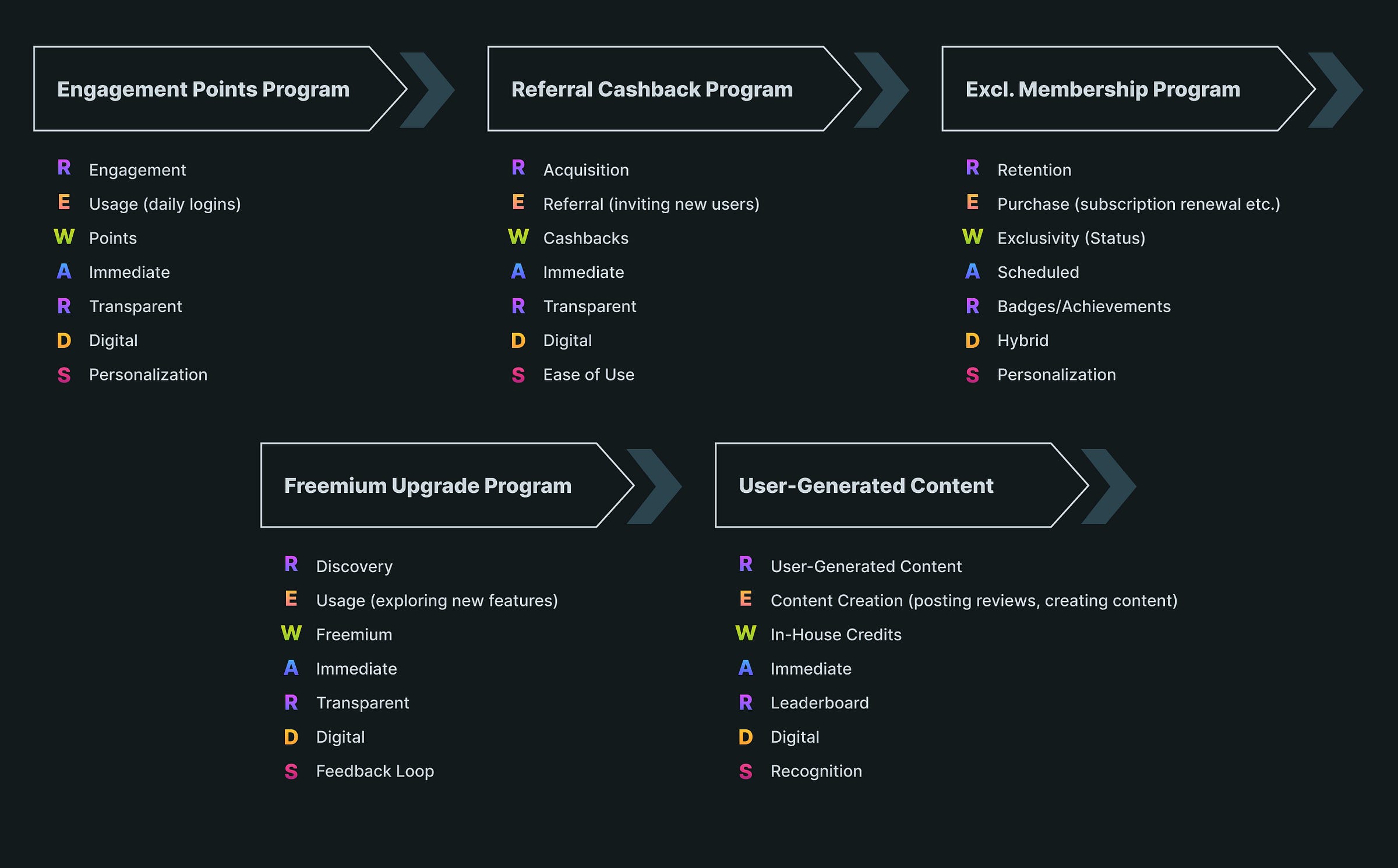

Combining the REWARDS Blocks

By mixing and matching different values from each block, you can create a customized rewards program tailored to your business goals and user motivations.

Here are a few examples:

How to Approach Devising a Rewards Program: A Practical Guide

Alright, enough with the theory. Let's roll up our sleeves and dive into the nitty-gritty of charting out your own rewards program.

While we've discussed the benefits of rewards programs at length, it's crucial to keep in mind that:

Rewards can’t improve your product experience: They can enhance, but not substitute a fundamentally good product.

A sustainable business can’t be built solely on a rewards program: It’s a supplement, not the foundation.

Rewards programs could be a major expenditure: Often second only to ad marketing.

Think of rewards as the supplements to your fitness regime, the jump start to a cold engine, the matchstick to a bonfire, the icing on the cake, or the aeration to a good wine. You get the idea 😅

Simply put, rewards can create a craving when a cue is encountered, but lasting behavior is formed when the entire experience is pleasurable and fulfills a desire to change the current state.

When Should You Introduce a Rewards Program?

The timing of your rewards program is critical. Introduce it too early, and you might burn through your budget. Launch it too late, and you might miss the opportunity to capitalize on user interest.

Here’s what should be in place before you start your rewards program:

1. Ensure Established Product-Market Fit (PMF)

It’s vital to validate that your product has traction and solves a real problem for your users. If PMF isn’t established, you might see a temporary boost in usage and engagement due to the rewards, but once the rewards are gone, so are the users.

Example: Jumpstarting a vehicle on an empty tank might get the engine running, but you won’t be able to drive far.

2. Optimize Product Experience

If your product is still in its MVP stage, focus on building a complete and delightful user experience. Identify and fix known drop-off points (leaky buckets) first. Otherwise, you’ll be hemorrhaging users while pumping money into rewards.

Example: Imagine filling a tank with a faulty valve. You’ll keep losing fuel until the valve is fixed.

3. Prioritize Organic Growth

Throwing money at a problem is easy but often unsustainable. Before introducing rewards, work on organic ways to boost your key metrics, such as engagement. This helps you understand what’s truly effective. Plus, without a baseline of organic growth, it’s hard to measure the actual impact of your rewards program.

Example: Traversing space without gravity assist will eventually deplete your fuel. Organic methods are your gravity assists, helping you conserve resources.

So, when should you launch a rewards program? Ideally, when you've exhausted organic methods of improving your key metrics or when further improvements yield diminishing returns. At this point, rewards can provide that extra boost to propel your product to the next level.

Once you have finalized that it's time to launch a rewards program you need to nail the next few steps:

Steps to Implement a Rewards Program

Identify Key Metrics: Define what behaviors or outcomes you want to drive (e.g., engagement, retention).

Choose the Right Rewards: Select rewards that align with your users’ values and motivations.

Set Clear Goals and KPIs: Establish measurable objectives to track the success of your rewards program.

Design the User Journey: Map out how users will earn and redeem rewards, ensuring it’s seamless and intuitive.

Pilot and Iterate: Start with a small-scale pilot, gather feedback, and make necessary adjustments before a full-scale launch.

Monitor and Optimize: Continuously track performance and tweak the program to maintain its effectiveness.

Well, that seems a bit over-simplistic? You must be wondering if you made all that effort to go through 3000 something words to get a 6 pointer which you could have guessed it anyways..

We understand it is not simple as it meets the eye and each of the above points hold several complexities within themselves. Don’t worry in our classic PMF: Perspectives, Frameworks and Markets style we will cover each of these with examples from our practical experience of implementing it while working on SmartCollect.

If you liked what you read until now do subscribe to not miss on more such articles in future!

How we built a rewards program?

The need to build a rewards program came while building a payment product at Flobiz. You might recall if you have read our previous blogs(link), in any case here’s a quick snapshot of the scenario

Quick Recap

We launched a payment collection product for MSMEs in India called SmartCollect

Our Goal: Grow it 100x within a span of 6 months

In the first month we were able to validate that the product had PMF and thus began the journey of scaling it organically.

By the third month we were done with most of the organic stuff and started processing 7Cr/ month

Now the challenge was scaling it further exponentially

We realized we would now want to create a habit to use this product amongst our users and approached the problem in that fashion - rewards was one way of achieving this.

And hence the work on rewards began

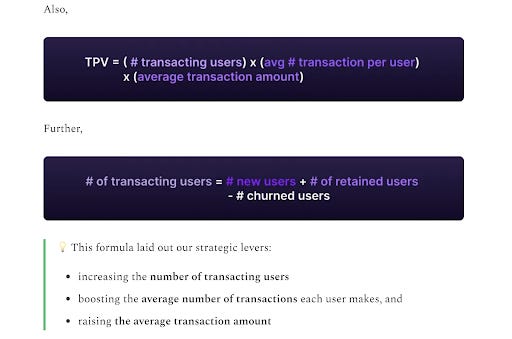

Step 1: Identifying Key Metrics

We knew from start ultimate metric that we wanted to target was

North Star = Total payment volume

From the last article we also know, as per our research following were the key challenges to the growth of SmartCollect:

User education

Awareness

Trust

Intent

So we knew we had to target the following goals, all at the same time:

Increasing Adoption

Increasing Retention

Building Trust

Now that we had this in place we were ready for the next step.

Step 2: Choose the Right Rewards

We had launched several rewards campaigns earlier for our billing and accounting product with different goals (increasing engagement, referrals etc) and had tried different types of rewards before as well with our user base. Right from leaderboards to discount coupons etc.

However we had realized that cashback rewards are the ones that had worked best for our users. So we went ahead with Cashbacks as the vehicle of rewards.

Step 3: Set Clear Goals & KPIs

From step 1 goals were set and now we had to set the clear KPIs to monitor the success of our rewards program.

Second, we knew from the start that nailing the rewards program would require multiple iterations and we would need to compare the results of each iteration with another.

So we had created several cohorts, we would allocate each iteration of the reward to each cohort and ensure a sacrosanct control group.

While analyzing the success we worked like paranoid men trying to find out reasons why it wouldn’t work and would turn the town upside down looking at several metrics, numbers etc.

We stuck to two simple metrics at a higher level to determine the success:

TPV Uplift : We would measure the TPV of each cohort and compare it with the control group. The % increase in TPV in the same time period against the control group would yield us TPV uplift.

TPV Uplift to Burn Ratio (Return on Spend) : When you divide the TPV uplift obtained above with the burn you incurred using rewards on the same set of users you get this metric. It essentially means with each single Rs spent on your rewards how much TPV uplift you were able to bring.

Step 4, 5 & 6: Piloting, Iterating and Designing the user journey

This was one of the most critical and interesting steps in our journey and we would go on to say for anyone crafting a rewards program this step is the blowtorch that would forge your success.

See, when we first thought of introducing Cashbacks to increase the adoption, retention of our payments products we weren’t sure if this would ever work. Our apprehensions stemmed from the following unknowns:

We hadn’t seen a rewards program work before for our users.

The product was kinda new - we had just seen rewards program work for Payment making platform as opposed to our payment collection platform.

We weren’t sure what amount of cashback would be sufficient for our users (our users were businesses who were probably collecting lakhs of payment - would a cashback of Rs. 50 entice them? )

Would it be economically viable ever?

All of this forced us to tread carefully and answer each of these one pilot at a time.

Version Zero

“Do things that don’t scale”

We took this quote from Paul Graham way too seriously and designed a completely offline rewards program. Sounds bizarre right? Well it worked for us though 😅

So how did it work? Here’s how:

Who would be part of it?

First we identified the cohort of users who would be part of this experiment: We identified a group of 610 users (who had enabled smartcollect, were paid users & they made more than 20 manual payment entries monthly):

Rewards Calling Group (305 users) : Users who were informed about the rewards and were rewarded.

Control Group (305 users) : These are the users who weren’t informed about the rewards and neither were they rewarded

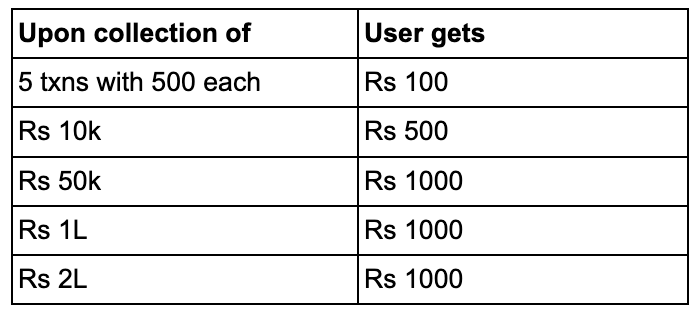

Rewards Construct

We had made an over simplistic reward journey based on the payment volume collected, following was the construct:

How did we arrive at these brackets? Simple, remember what our goals were - increase adoption, increase retention, build trust. We looked at data for our users who were organically using the product:

Users who had collected a sum of 10K were likely to adopt the feature and be comfortable with it.

Users who went on and collected over 50K were likely to do it in more than 5 payments - the definition of retention at the time.

We had also observed - collecting a payment in large sums (in excess of lakh) - was the highest form of trust shown by the businesses.

User Journey

Using our support and sales teams we would call users from both the cohorts - experiment & control - and collect feedback regarding the product and introduce the concept of cashback (verbally & by sharing the pamphlet) to the users in the experiment cohort.

While the agents would just iterate the benefits of the product and help users with the feature education while calling the control group cohort.

We had created a dashboard of the payment collected by each of these customers of the experiment cohort.

At EOD we would see which user qualified for what rewards and would send the user a Razorpay Settlement link to share the cashbacks. The agent would then call the user the next day to see if the user received the cashback and motivate them to try for the next milestone.

This went on for a month as we awaited for the result. I would like you to take a pause here and guess if it would have worked? (prolly drop your guess in the comments 😅)

Outcomes

Total Payment Volume: The rewards group performed way better than the control group processing almost 3 times the payment volume.

Effect on Activation Time: If we observe closely the peaks of both the graphs, rewards group graph peaks 1-2 days earlier than the corresponding control group peak, this means that rewards helps users activate faster.

Effect on Adoption: 40% users who received a reward started doing payments continuously, as compared to control group where, for 15% users there was a slight improvement in consistency

Wow! This had actually worked, while we were rooting for its success but we were pleasantly surprised by the overwhelming effectiveness.

Have you employed such hacky tactics to test out a feature and it worked magically? Let us know in the comments about it..

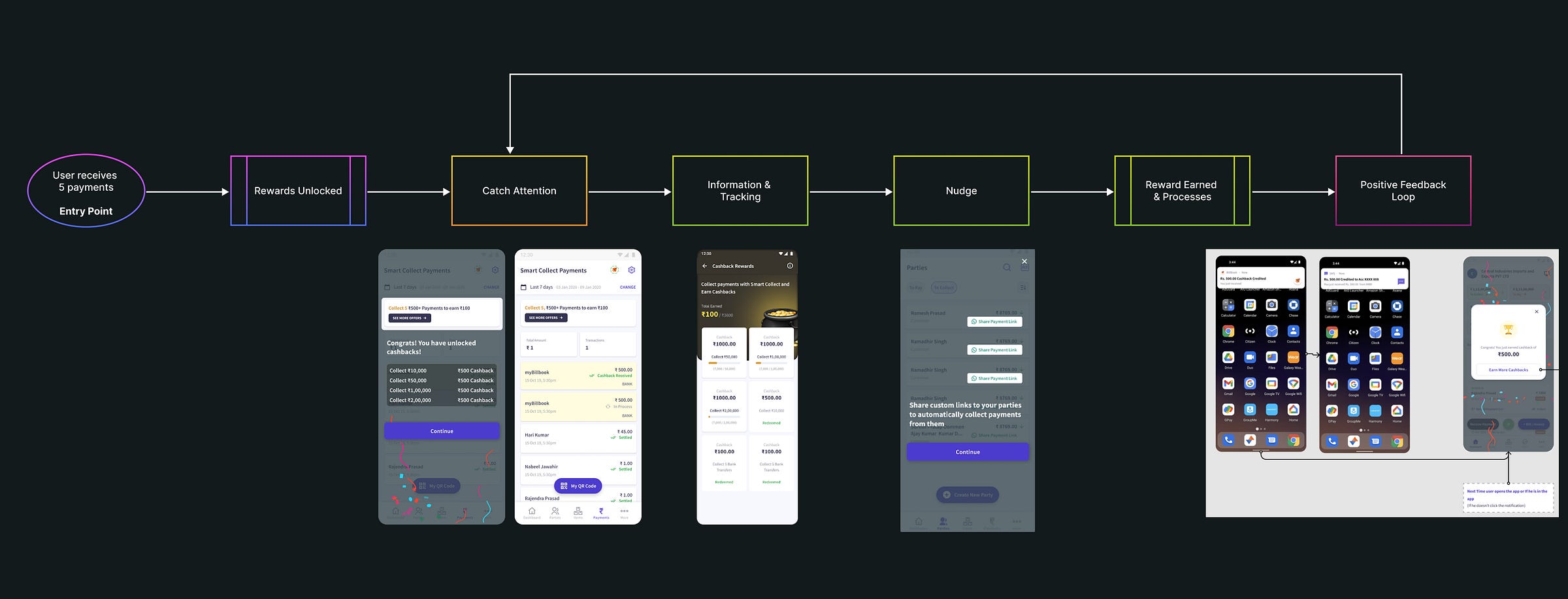

Version Uno

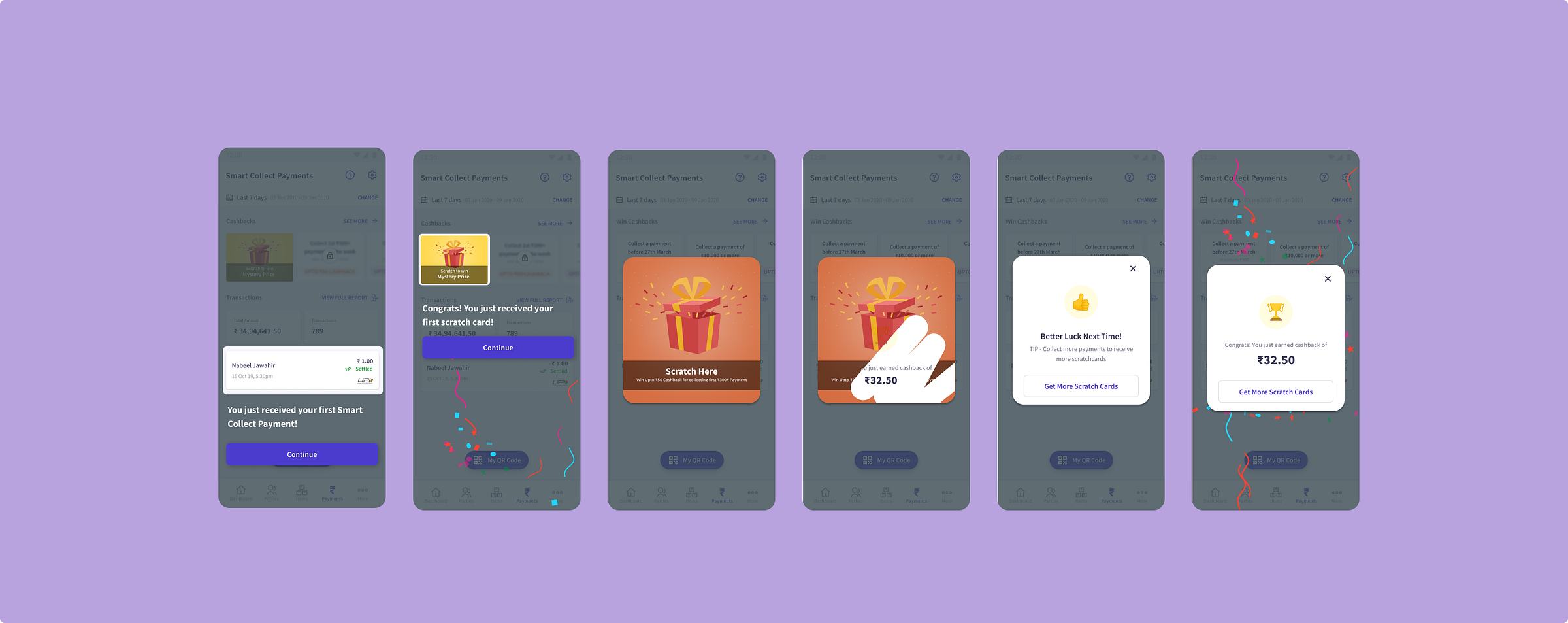

The next obvious step was to make this program scalable as it was impractical continuing it offline and extremely expensive. Hence we had to make it digital for it to become scalable.

However, continuing on our skepticism, we tried to find reasons why this would not work and absence of a sales agent contacting the user to motivate them to earn a reward seemed like the sure shot point of failure while making it digital.

So as for the next step we focussed on just disproving this hypothesis, we tried to replicate the same rewards program as is digitally.

Rewards Construct

You can see an addition of a new category - “5 txns with 500 each”, we wanted to be more direct with respect to our retention goals. However we were cognizant of the fact that these 5 payments have to legitimate payments and shouldn’t be gamed by transferring Rs 1 worth of payment 5 times and earning 100 Rs for the same.

User Journey

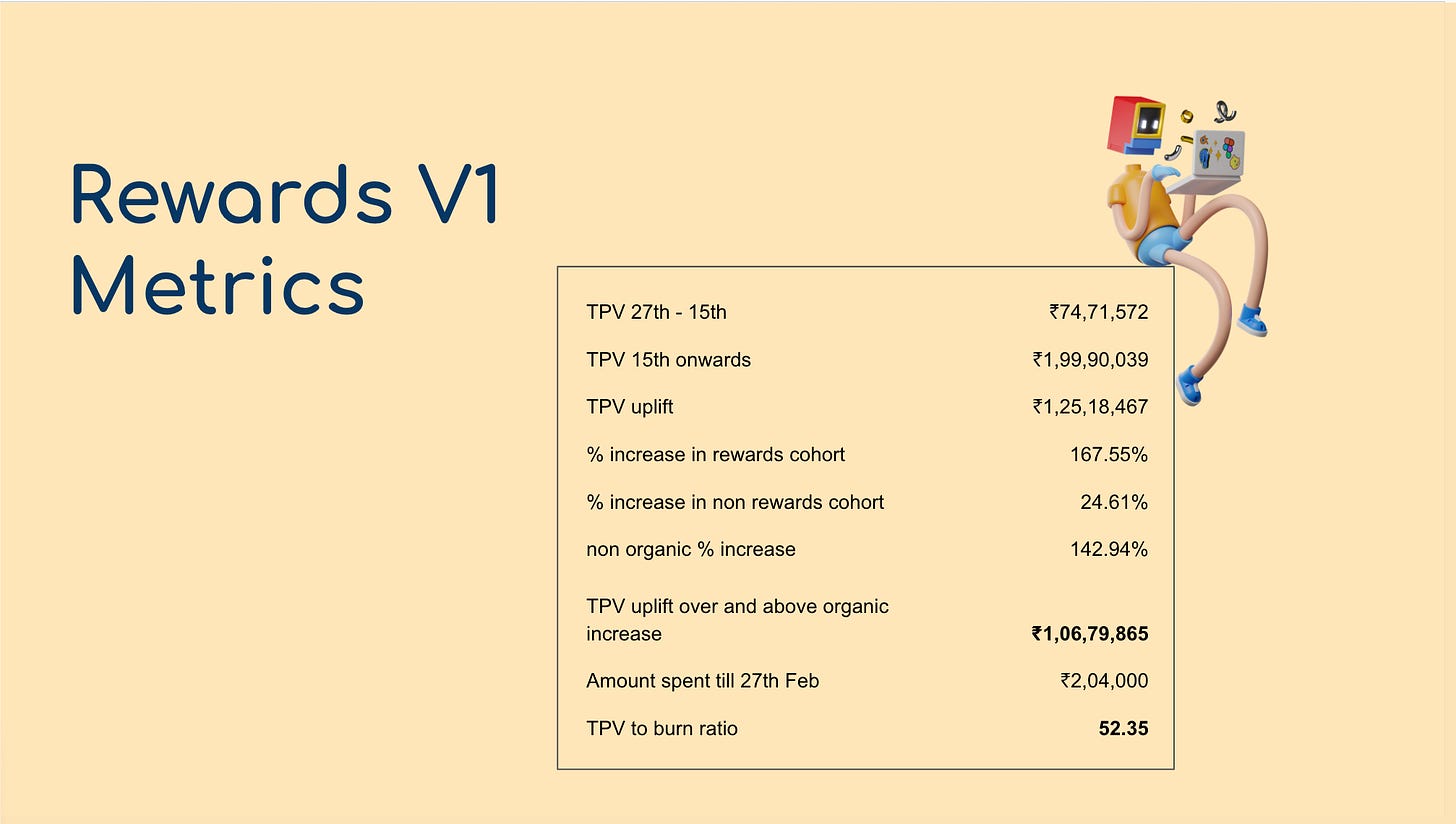

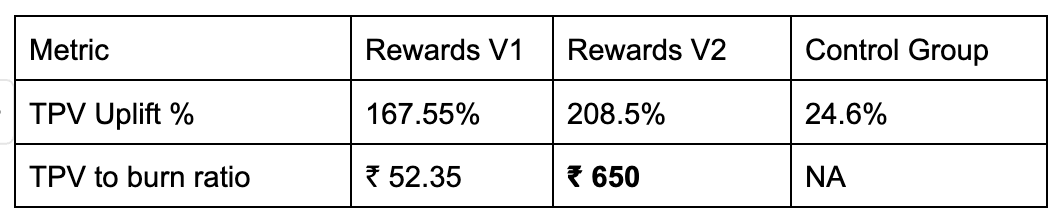

Outcome

Here it is important to note that the TPV also increased by 24.6% percentage points for the control group as well - many of you would wonder why this increase?

Well, this is the organic adoption of the product, this is usually the case in early lifecycle of the products hence it is even more imperative to compare the rewards cohorts performance against the organic adoption!

And it worked!

💡Note: Here for every 1 Rs spent on giving out rewards we got and additional Rs. 52 worth of transactions flowing through our platform

Hence we rested our suspicions and could conclude that rewards worked. Now what’s next?

Version Dos

I know it has been a lot to digest until now so before moving forward lets recap a bit:

We launched Rewards V1 and we had following questions :

Do rewards help increase TPV?

Do rewards improve user consistency even after the user has claimed all the rewards?

Do rewards help activate users who were inactive?

We found answers to these questions, and rewards impacted each of these positively.

While achieving we incurred a Burn to TPV ratio of 52.5 (against an estimated ratio of 25).

But was it all rosy? No, we still had several challenges and going forward we would have wanted to address them and fix each of these:

Challenges towards a Successful Rewards Program

High Burn : Rs 3600 cashback for everyone (More than our premium plan price of our SaaS platform). Also becomes a blocker in adding more reward categories.

Linearity : It stops at Rs 2L and the user knows for sure nothing is ahead in the rewards journey, which may cause loss in motivation.

Fixed rewards: In studies, variable rewards have proven to be more habit forming and hooking.

Treats all users the same: A vada paav center whose avg ticket size is Rs. 40-50 is rewarded the same amount as a Sand Unit distributor whose avg ticket size is around Rs. 50k.

Now we had to go back to the drawing board once again and had to rethink our entire rewards program from scratch. After a lot of thought we came up with the following concept:

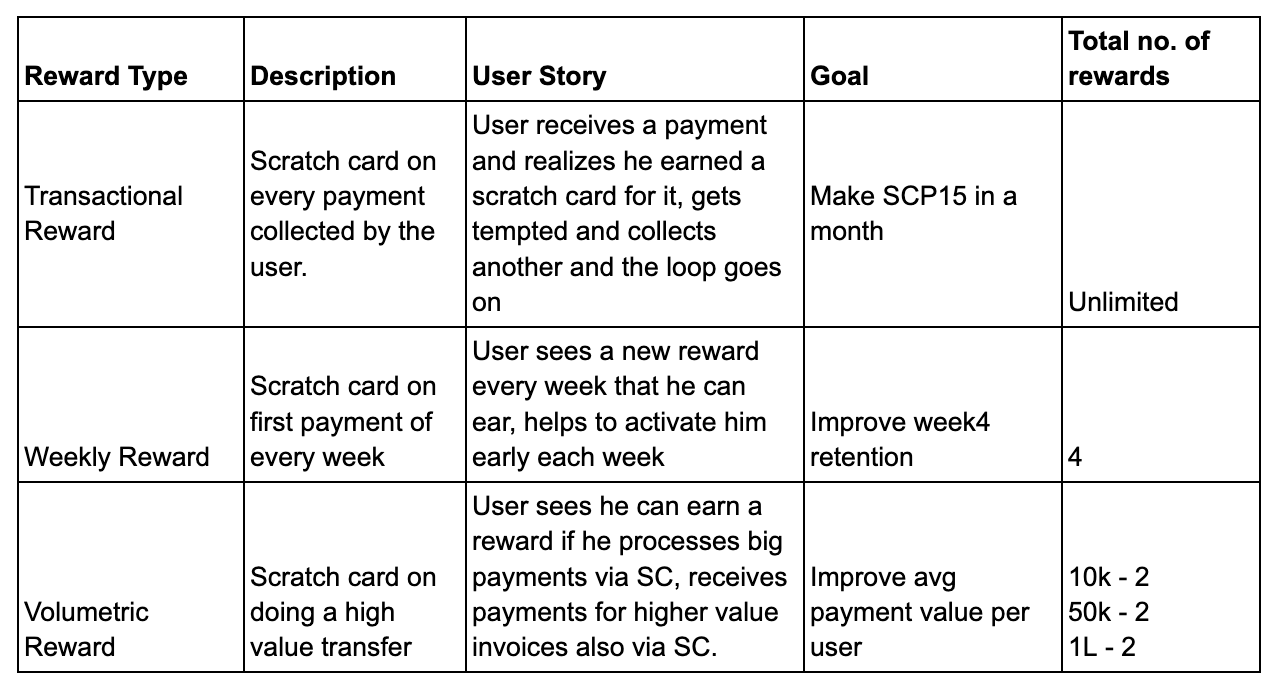

High Level Concept

The rewards would be eternal, the user would always be anticipating a reward.

Rewards would be variable, user can’t predict what amount of reward would he get :

“Variable rewards must satisfy users’ needs while leaving them wanting to re-engage with the product.”

Three categories of rewards:

Notice how we shifted to scratch cards to introduce the concept of variable rewards and play with that dopamine cycle of the user a little more.

Who would receive this?

From now on things got a little more complicated we now were not just looking to check the performance of the rewards cohort to the control group but we wanted to check the performance of this new construct of rewards with the previous construct as well.

That would have made sure the new construct works and works better than any other rewards construct.

So create three cohorts of users - Rewards V1, Rewards V2 and Control Group.

User Journey

Outcome

We can clearly see that Rewards V2 had a higher impact on our TPV while being significantly cheaper (atleast 12x).

💡We got Rs 650 worth of transactions flowing through our platform as compared to Rs 52 while spending a rupee on granting rewards to users

So, there you have it—a comprehensive look at how we built and optimized our rewards program at Flobiz. We've shared the highs and lows, the successes and challenges, and the meticulous process of iterating our way to a scalable, effective rewards strategy.

But wait, don’t go just yet. We’re not done!

While we’ve covered the foundational steps and shared our journey with SmartCollect, there's more to explore.

What’s Next?

Variable rewards might seem straightforward, but have you ever wondered how different companies design algorithms to implement them? This process can range from simply hardcoding values to developing sophisticated machine learning (ML) pipelines that calculate reward amounts based on a myriad of factors.

Your first instinct might be to go all out with an ML model, analyzing every conceivable data point—from user demographics and engagement metrics to their likelihood of conversion and even what they had for breakfast. Sounds fancy, right? But here’s the kicker: it’s often impractical for products in their early stages.

The Real Challenge

For most products in their 0 to 1 and 1 to 10 journeys, this sophisticated approach is not only time-consuming but also data-hungry. Most early-stage products lack the historical data needed to train such models effectively. In our case, SmartCollect had only been live for two months, and the rewards program was just a month old with fewer than 2,000 participants. Any model trained on such limited data would likely be inaccurate and unreliable.

So how did we do it?

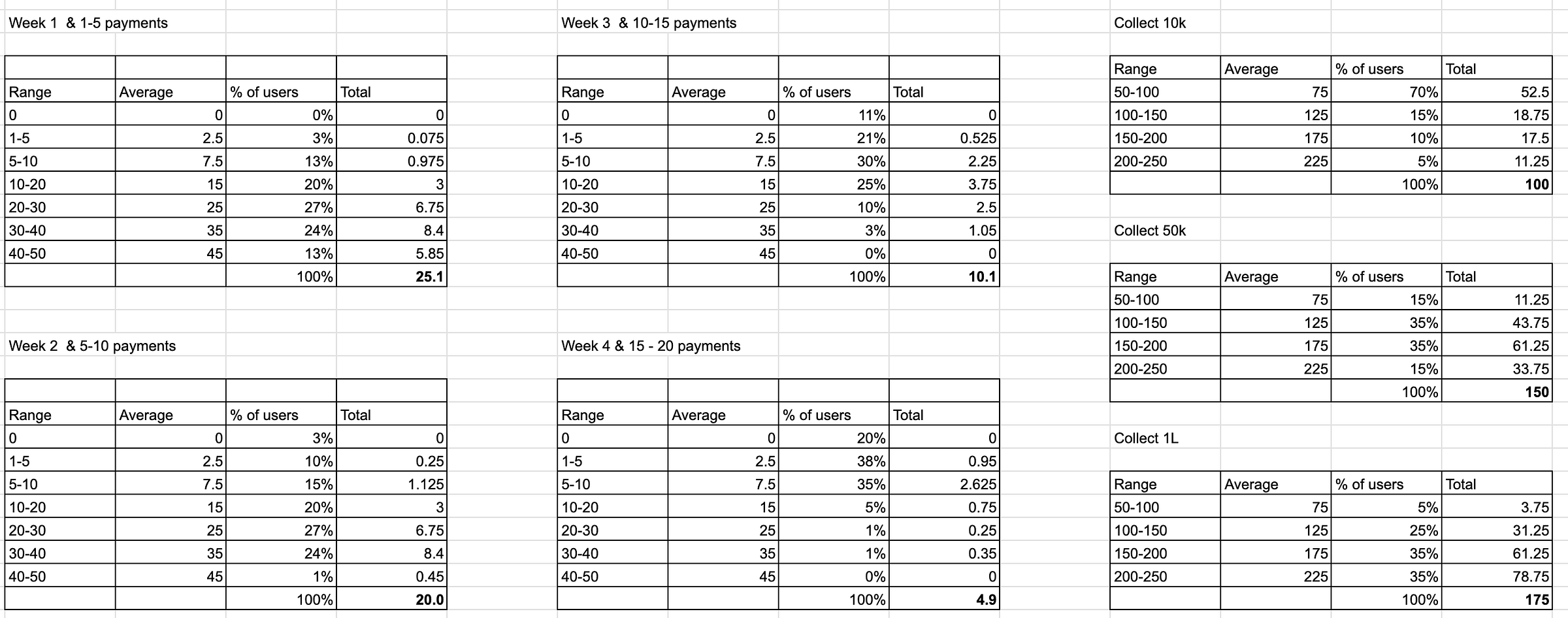

To design our rewards program, we struck a balance between simplicity and sophistication. Here's how:

Step 1: Start with Static Rewards

We began by determining a static reward amount based on our budget and the TPV/Burn ratio we wanted to achieve. This static reward amount represents the average reward distributed over a specific number of recipients.

Step 2: Introduce Variability

To make the rewards more engaging, we distributed the rewards in a variable manner while keeping the average decided in step 1 consistent. This variability could follow either a uniform distribution or a normal distribution.

Let's take a deeper look at our approach:

First by doing rigorous analytics we tried to bring out trends from our user’s usage patterns to uncover the trigger points for each reward, these were the points where the users would need an extra bit of motivation to drive them forward in the journey

Second we determined the average reward amount we wanted to divulge for each category of the reward and the min & maximum possible value of the reward.

Finally determine a distribution around to average for each reward.

Here’s what our rewards looked like :

There are some key things to note here:

There are a mixture of three types of rewards :

Weekly reward : Target Retention

Transactional reward : Targets engagement

Volumetric reward : Targets building trust

For each reward of the same category, notice how for every subsequent reward has a diminishing average amount. This is to ensure we don’t overspend even after the habit has been formed in some users.

Bigger the effort, the bigger the reward for the users.

Finally to determine the distribution for each reward we used the following heuristics:

Why Your Rewards Program Might Fail

So, you've put in the effort, designed what you thought was a stellar rewards program, and now you're watching the engagement metrics. But instead of skyrocketing, they're flatlining or even declining. What went wrong? After all the meticulous planning and execution, understanding why a rewards program might fail is just as important as knowing how to build one.

Here’s an exhaustive evaluation of the potential pitfalls and how to avoid them, ensuring your rewards program remains effective and engaging:

Thanks for sticking till the end!

Subscribe now and don't miss out on other parts of this series! Feel free to continue exploring the intricacies of:

From Zero to Hero: A Payment Product's 100x Journey (part 1 of this article)

Designing KYC: a bachata feat. Growth and Compliance💃 (part 2 of this article)

Fighting Payment Frauds as a Fintech Startup (part 3 of this article)