From Zero to Hero: A Payment Product's 100x Journey

Dive into a growth journey full of adoption challenges, first-principles growth strategies, applications of behavioural psychology and understanding of payments jargon like virtual accounts

Welcome to PMF: Perspectives, Markets & Frameworks 🌈, where we endeavour to shed light on the intricacies of product management and delve into the unique aspects of India's market landscape.

In our first issue, we're humbly attempting to bring you closer to the story of Peak XV and Elevation Capital-backed FloBiz's Smart Collect. This narrative aims to share insights, navigate the complexities of the payment ecosystem, and document our journey towards simplifying business management for Indian SMEs.

Often, when we think of the birth of groundbreaking products, our minds drift to those solitary 'aha' moments, perhaps in the shower 🚿, where a stroke of genius strikes out of the blue.

Yet, this romanticised image is so far from reality, that it might as well be orbiting a distant galaxy. Most success stories happen in cramped meeting rooms, instead of one person, there is a whole team, fueled by cups of coffee ☕️ and a shared dream.

One such story is ours when we at FloBiz launched a payments product - Smart Collect on myBillBook (our flagship accounting app) in 2021. We wanted to make payments so easy and intuitive that businesses could do it with their eyes closed (though we don’t recommend trying that 😅). Fast forward through countless brainstorming sessions, coding marathons, and yes, a few disagreements on the way, we grew the product 100x in payment volume within 6 months! Sounds crazy right?

Now that we’ve got you curious let’s dive into it deep. Keep reading it’s been quite the ride.

Table of Content

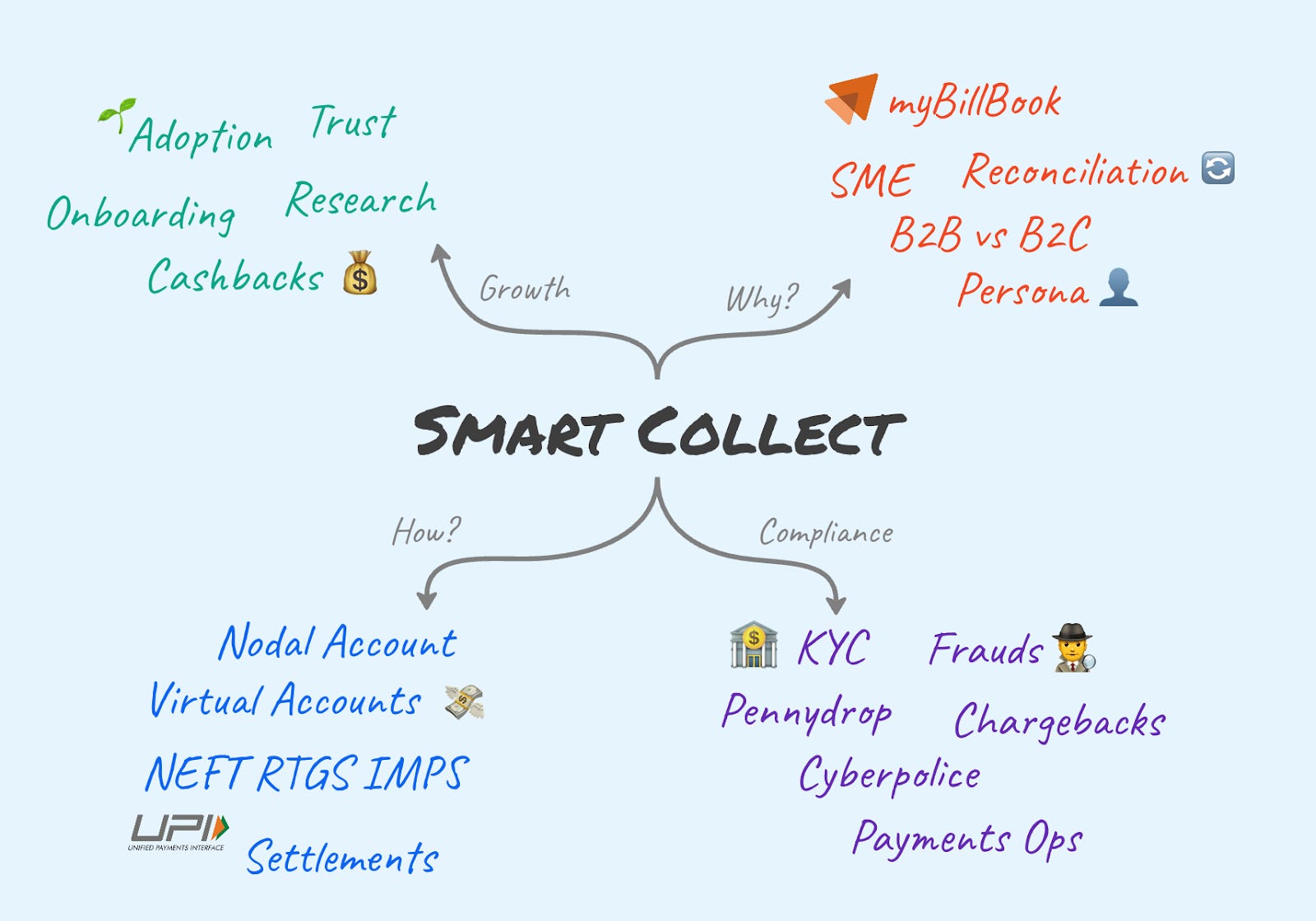

Chapter 1: Genesis of myBillBook and Smart Collect Goals

What led to myBillBook's evolution and the introduction of Smart Collect?

What are the key payment challenges faced by Indian SMEs?

Chapter 2: Leveraging insights from myBillBook data

What are the different user persona of SMEs on myBillBook?

How do SMEs' payment preferences influence product decisions?

Chapter 3: Building blocks of Payments

What are virtual accounts and nodal accounts?

What should one look for while selecting a payment gateway or aggregator?

How did KYC differ for PhonePe, Paytm, and Google Pay?

What are the challenges with KYC and how did we solve them?

Chapter 5: Navigating the Post-Launch Landscape

What were some initial indicators of success?

What were the main challenges faced in achieving sustained growth?

Chapter 6: 100x Growth Strategy

What were the key levers to drive growth?

What insights were gained from analyzing users' behavior?

How did we facilitate the formation of payment habits among users?

Chapter 7: The Battle Against Payment Frauds

How did we identify potential fraudsters and mitigate fraudulent activity?

What were some examples of the types of fraud encountered by us?

Chapter 8: Reflections and Farewell

What factors influenced our decision to sunset Smart Collect?

Just a heads up: This guide is quite comprehensive (long read), so feel free to save it or share it with friends (or yourself) for later reference.

The Genesis of myBillBook

FloBiz embarked on a mission to empower India's SMEs, a sector brimming with potential yet facing many challenges, including the critical credit gap, cumbersome GST compliance and inefficient business processes. Recognizing this, we introduced myBillBook in 2019, a comprehensive GST billing and accounting app designed to meet the nuanced invoicing needs of SMEs; trusted by 10 million SMEs today.

By facilitating end-to-end business management through features like e-invoicing, inventory management, staff attendance, and GST filing, myBillBook became the cornerstone of our strategy to empower businesses. This was just the beginning.

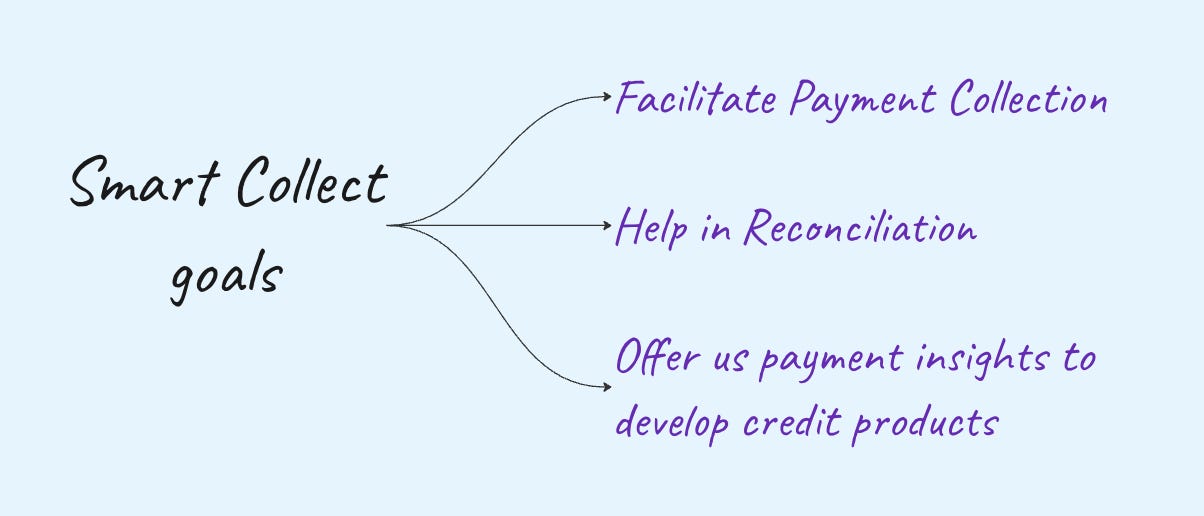

The Evolution Towards Payments

As we delved deeper, the struggle to collect payments soon emerged as a constant battle for businesses, with credit cycles stretching from weeks to months, leaving SMEs in a perpetual state of financial limbo. The added burden of late payments and the constant need for follow-ups aggravated this issue.

Moreover, the cumbersome process of payment reconciliation posed a final hurdle. Businesses found themselves navigating through various bank websites, payment apps and accounting software to match payments with bills, a daily ordeal costing them precious hours.

These were reasons enough to build a payment product, one more insight led us to develop our first payment product:

Billing data alone was insufficient for our credit aspirations

A bill does not confirm a transaction; only a corresponding payment can validate it. While we had initially enabled users to add their bank accounts and UPI IDs on their invoices, we lacked visibility if any transaction would have hit their bank account because that would have happened on another app.

💡 One may argue that one can get this information using SMS data however it is difficult to ascertain:

Which payment corresponds to which customer

Even if we could identify the customer, we'd struggle to match the payment to the relevant invoice for reconciliation

Recognizing these challenges as opportunities, we were inspired to innovate once more. Our vision? A bespoke payment product tailored specifically for Indian SMEs.

Leveraging insights from myBillBook

Venturing into the payments space necessitated a foundational question:

What exactly are we going to build? The answer lay not in the technology itself but in the needs and behaviours of those it was intended for. Thus, understanding our user persona became paramount.

SMEs User Persona: A Diverse Spectrum

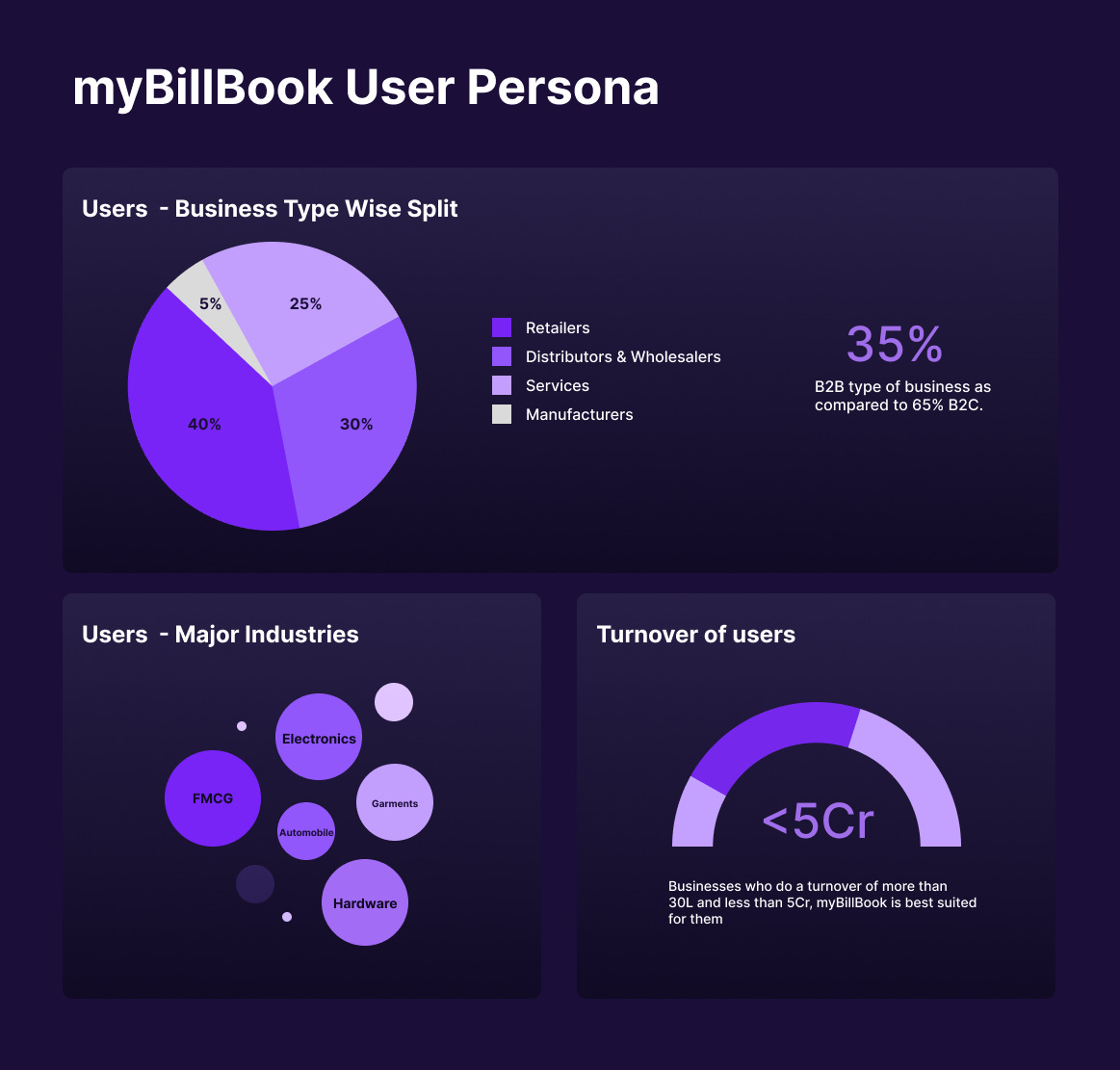

💡 Our users at myBillBook were small businesses generating an annual turnover between ₹30 lakh to ₹5 crore. This represent a broad spectrum of the Indian economy. These businesses can be categorized based on two primary classifications: the nature of their business (retailers, distributors, wholesalers, manufacturers, and service providers) and their industry domain (FMCG, electronics, garments, pharma, hardware, automobile, etc).

Armed with these insights, the blueprint for our payments product began to take shape. Our goal was not just to introduce another payment solution but to craft a tool that addresses specific needs and challenges of our diverse user base. This meant prioritising features that offer flexibility, security, and ease of use across a variety of transaction types and sizes—tailored to the distinct workflows of retailers, distributors, wholesalers, manufacturers, and service providers.

Understanding SME’s Payment Behaviour

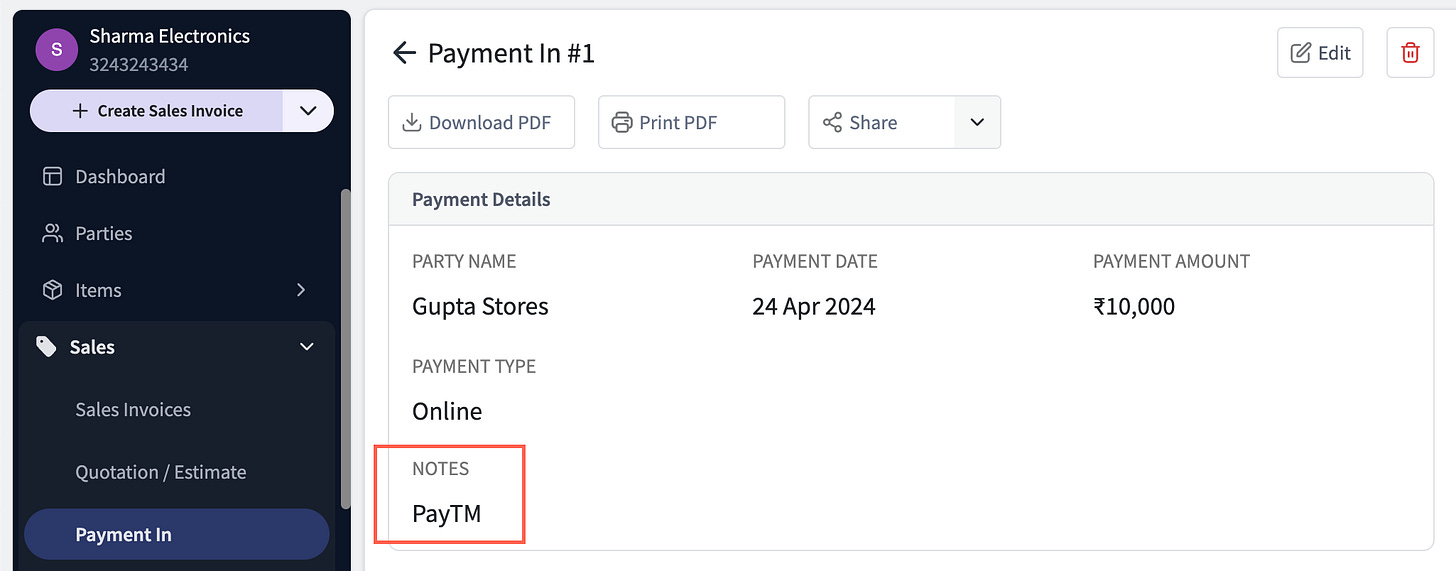

To decipher the payment collection behaviour of our users, we went a step further and analysed the manual Payments-In vouchers created by our users on myBillBook.

Specifically, we reviewed the comments mentioned in the “Notes” section of all “Online” payments. We were looking for keywords like UPI, Google Pay, Paytm, PhonePe, Bank, IMPS, NEFT, RTGS, etc.

We found the following insights:

💡 Our analysis highlighted a key trend: 1.5x higher usage of bank transfers (NEFT, RTGS, IMPS) compared to UPI on myBillBook!

This can be attributed to two factors:

Transactions involving B2B businesses (distributors/wholesalers), who accounted for a substantial 35% of our users, typically involve larger sums requiring bank transfers (as UPI has payment limit of Rs 1 lakhs).

Unlike retail where UPI QR codes from Paytm, BharatPe, PhonePe etc. have gained wide adoption, efficient payment collection methods for B2B transactions are still lacking.

Recognizing this opportunity, to capture a decent share of the payments market on our platform, we strategically optimized for B2B payments. This involved prioritizing a smooth and secure bank transfer experience while also integrating UPI as an option for smaller transactions, offering our users the flexibility they need.

Building blocks of Payments

There are two most common options for facilitating payments via bank transfers: Net banking and Virtual Accounts.

1. Net banking: Easy Setup, Low Adoption

Pros: Simple integration with a payment gateway, offering users various payment methods (net banking, UPI, cards).

Cons: Low adoption due to security concerns (entering bank credentials on third-party links) and user unfamiliarity with the payment flow.

2. Virtual Accounts: Replicate Existing Behavior, High Implementation Effort

Pros: Offer virtual accounts that mimic users' existing payment experience (NEFT / RTGS / IMPS).

Cons: More complex setup and management for us (we’ll discuss it later)

But first.

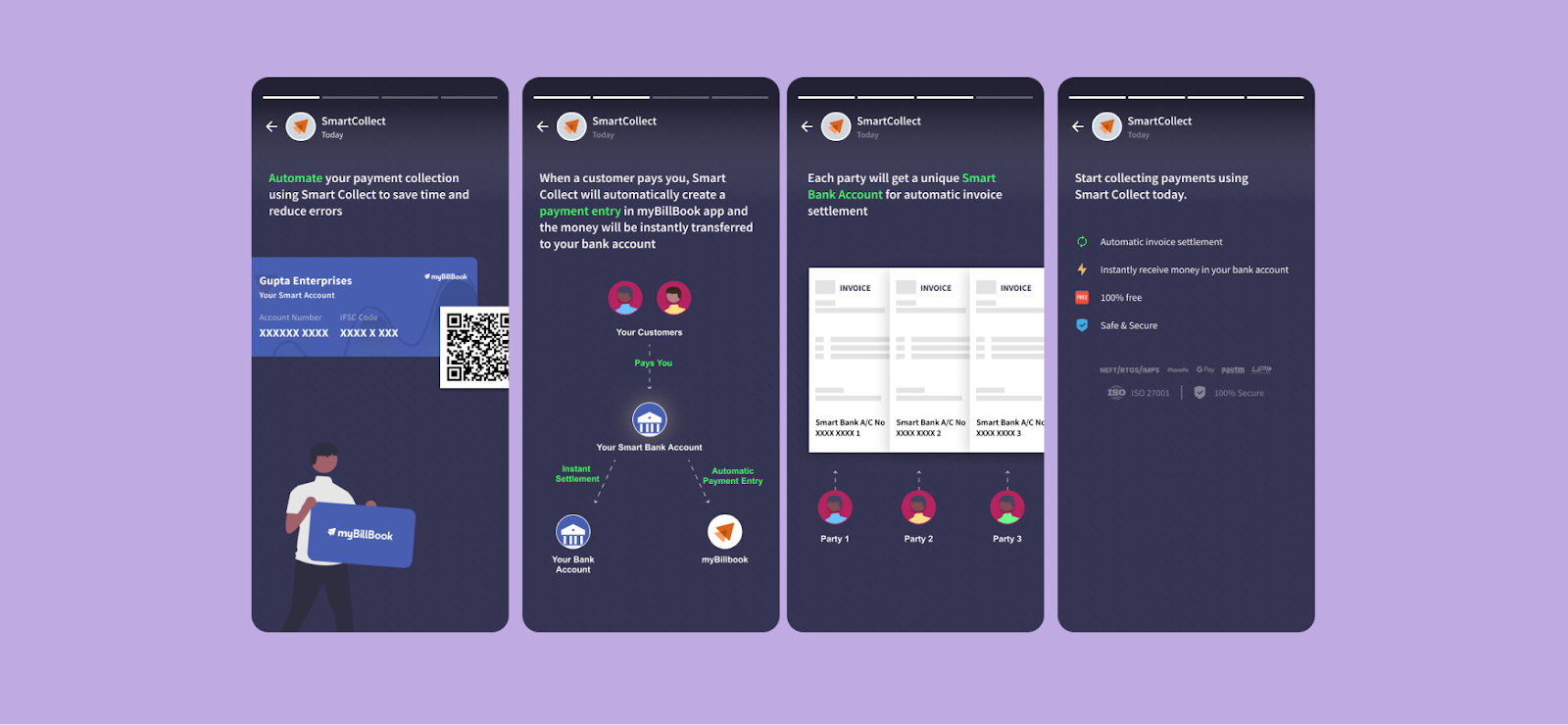

What are Virtual Accounts (VA)?

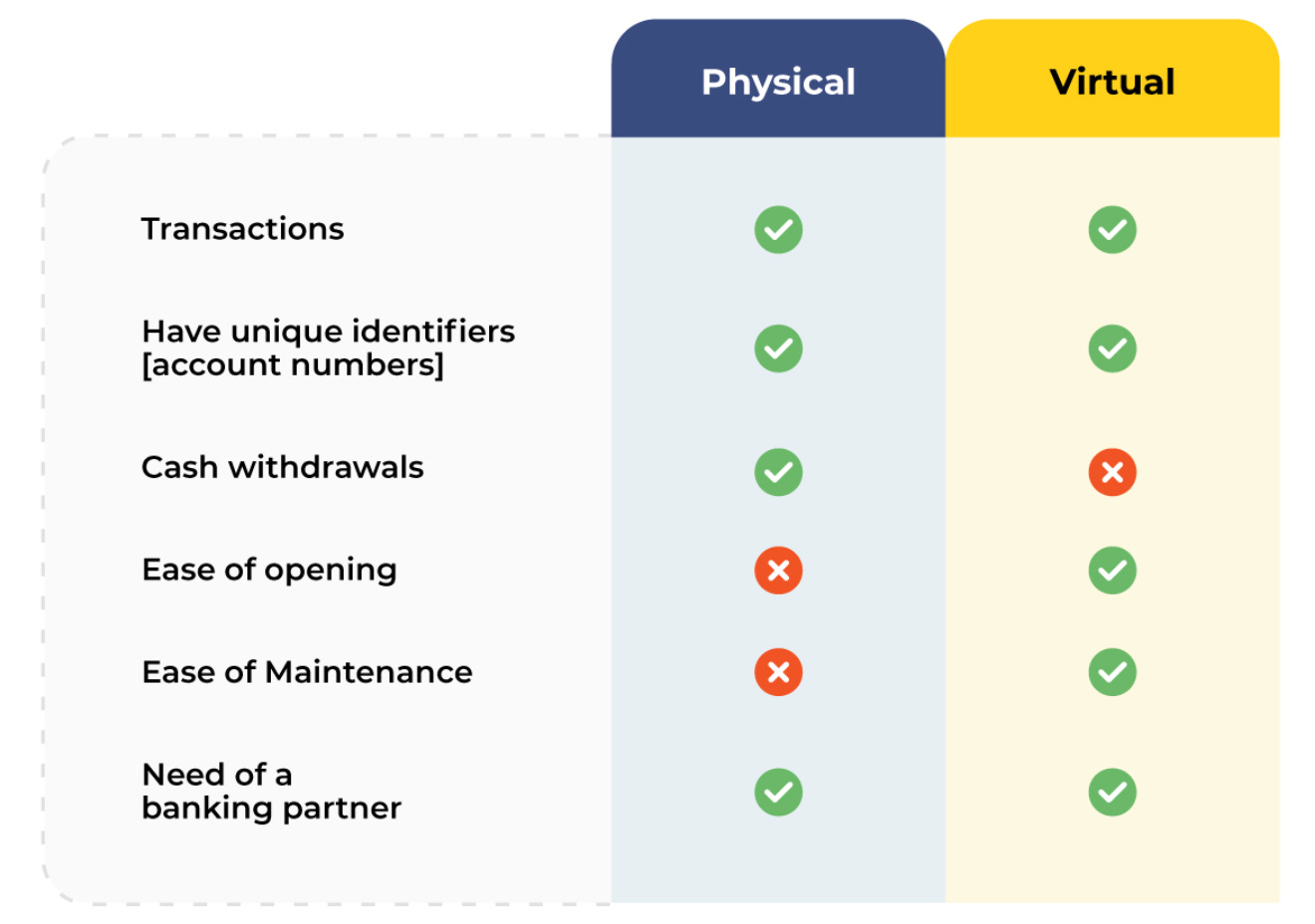

Virtual accounts are bank accounts with no physical existence, are temporary, and transact on behalf of a real, physical account. A virtual account has a unique account number that makes it easy to trace the funds coming through it and helps to identify the source or the payer.

A virtual account’s operating and maintenance costs are significantly lower than physical accounts. It’s easy for a business to open hundreds to thousands of virtual accounts while doing the same for physical accounts would be nothing short of a nightmare.

How do Virtual Accounts Work?

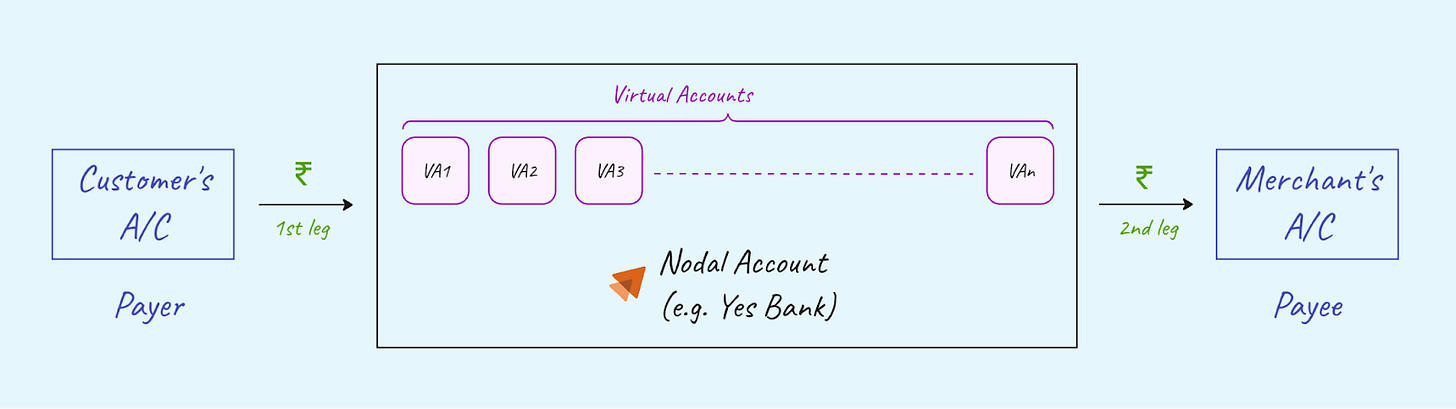

Anyone can transfer funds to a virtual account through traditional bank transfer methods such as NEFT, IMPS, or RTGS. The funds stay within the virtual account only temporarily until it’s transferred to the payee. This second leg of the transaction from the VAs to the payee account is called a “settlement”.

Most payment service providers allow the creation of a UPI ID and a UPI QR associated with the virtual account. This way people can even collect funds via UPI on virtual accounts.

Virtual accounts work automatically and operate in real time. Businesses can easily track individual payments and automate reconciliation, ensuring the most accurate invoice-payment match. This makes them an efficient and almost essential alternative to traditional bank accounts.

Do you like where this is going? Subscribe so that you don’t miss future issues

Creating Virtual Accounts

Virtual accounts can be created on top of:

Nodal or Escrow Account

Current Account

Refer to this blog to understand more about Nodal Accounts. Essentially, Nodal Accounts acts as a temporary vault to store and distribute the money to relevant parties.

In our case, since we were collecting money not for ourselves but on behalf of our merchants, it made sense to create Virtual Accounts on top of a Nodal Account. This ensures that money does not legally belong to the us, at any point in time and acts as a trust factor.

We had two options here:

Getting our own Nodal Account, or

Operating using our payment partner’s Nodal Account

💡 Getting a Nodal Account itself is a time-consuming process and requires other compliances and costs like third-party auditor, etc. Hence, we initially decided to operate using our partner’s nodal account.

Our payment partner, Hypto (more on that later), had multiple nodal accounts which we could have used to create our Virtual Accounts. We decided to go ahead with their Yes Bank’s Nodal Account as Yes Bank at the time had the best payment stack and lowest payment failure rates in the industry.

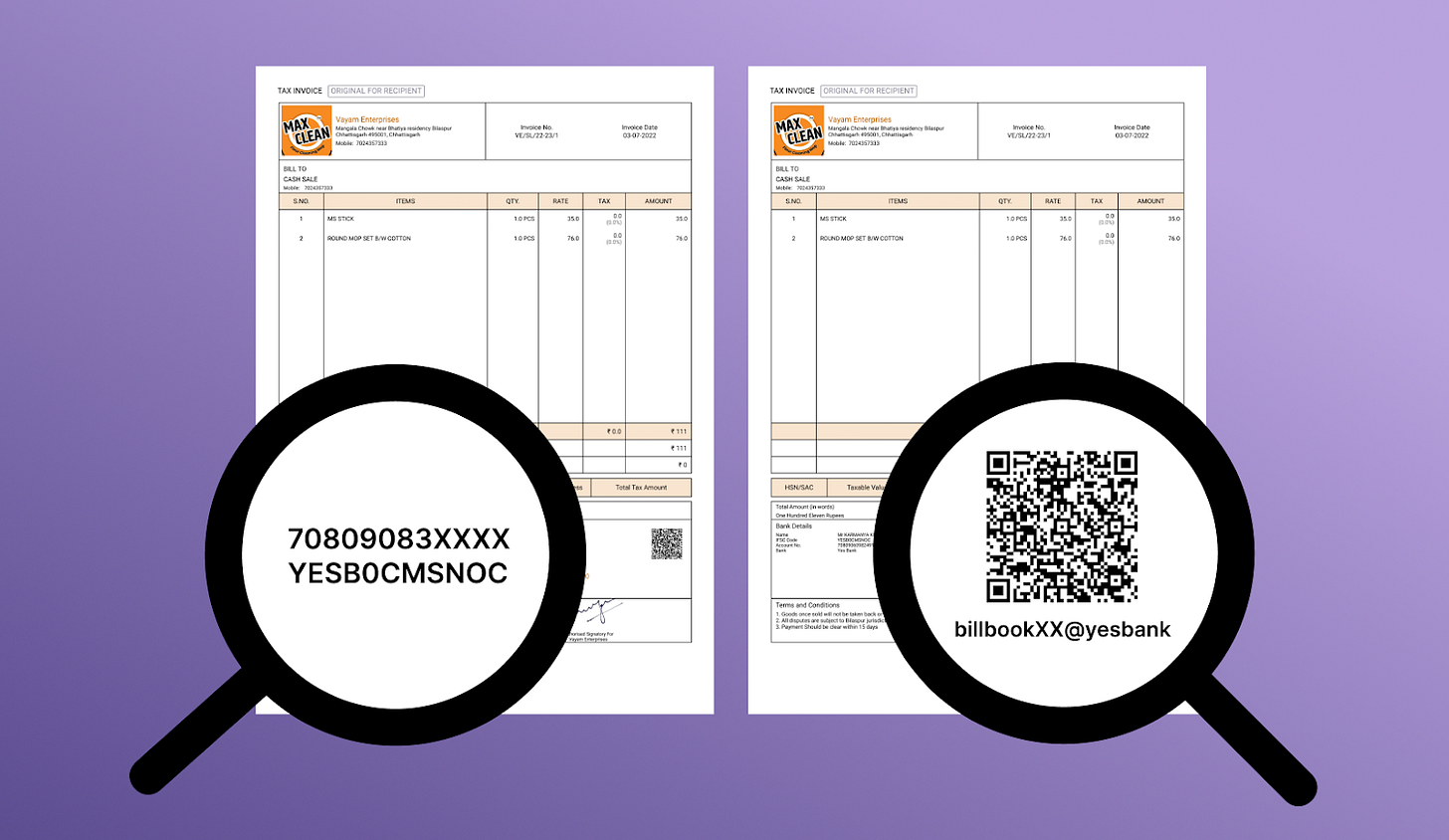

All myBillBook VAs have the prefix ‘70809083’ followed by a random 8-digit suffix. Similarly, all UPI IDs generated on top of our VAs would have a ‘billbook’ prefix followed by the same 8-digit suffix.

Virtual Account Creation Strategy

By creating Virtual Accounts for our users, we figured we could solve all three things: (1) payment collection, (2) reconciliation and (3) replicating existing payment behaviours.

Next, we embarked on a quest to explore various Virtual Account (VA) creation methodologies, each with its unique potential:

Business-level VA: One VA for each business registered on myBillBook.

Invoice-level VA: One VA for each invoice generated on myBillBook.

Customer-level VA: One VA for each customer created on myBillBook (by a myBillBook user aka merchant).

An in-depth analysis, which is summarized in the attached table, led us to an informed decision. The “Customer-level” VA approach emerged as the most effective approach, balancing the need for detailed tracking with simplicity.

💡 Here’s a snapshot of our implementation:

Every myBillBook merchant will have an multiple VAs one for each customers, ensuring easy reconciliation

Each customer's VA appears on all their invoices

Customers can only see their dedicated VA, while merchants can see VAs for all their customers

Incorporating Cash Sales

Alongside various “Customer-level” VAs, we recognized that most SMEs in India also engage in “cash sales”, which typically do not require detailed record keeping. To address this, we created one extra VA for each myBillBook user (termed “Business-level” VA) for these transactions.

A UPI QR code was created for these Business-level VAs that the businesses can physically put in their shops for collecting small retail transactions.

Building a Hierarchical System of VAs

We then established a hierarchical system where the "Business-level” VA operates as a parent account to the multiple "Customer-level" child VAs.

Payments received in customer-specific child VAs are immediately channelled through the merchant’s business-level VA. This process ensures a centralized collection point before the funds are seamlessly transferred into the merchant's physical bank account for final settlement.

This VA strategy of Business-level and Customer-level VAs creates a robust, seamless payment and reconciliation system.

Choosing the Right Payment Partner

💡 In our quest for the ideal Payment Service Provider (PSP), we prioritized the following criteria:

High-quality customer support

Ease of integration

Pricing

Speed of settlement

Flexibility for custom development

Our search encompassed a diverse group of potential partners, ranging from conventional banks like Yes Bank and Axis Bank to fintech innovators offering Payment APIs such as Juspay, Decentro, Setu and Hypto, and obviously Payment Gateways like Razorpay and Cashfree.

Banks promised attractive commercial terms but required more time for integration. On the fintech side, Setu and Juspay were ruled out early on as they did not support Virtual Accounts (VAs). This left us with Razorpay, Cashfree, Decentro, and Hypto—each known for their robust teams and products, with whom we've had some form of past interaction.

We needed a partner capable of supporting a hierarchy of VAs and offering instantaneous settlements—two non-negotiable requirements for us to ensure our B2B merchants could maintain the pace of business they achieved through NEFT/IMPS/RTGS systems.

Razorpay and Cashfree, despite their solid reputations, did not fulfil these requirements at the time, particularly falling short on an instant settlement (without additional charges or maintaining a float). Hence, the choice came down to Decentro and Hypto.

Selecting Hypto was a no-brainer for us due to their competitive pricing and their agile, responsive team. They quickly developed a hierarchical VA system within just 3 days during our trial phase and provided a tailored single API for generating both VA and UPI ID, saving us valuable time and hassle compared to other providers.

Hypto’s readiness to tailor their services to our needs and their proactive approach significantly influenced our decision, ensuring that we could provide our merchants with the seamless, instant settlement process they require.

If you had the same initial conditions that we did, what would you do differently?

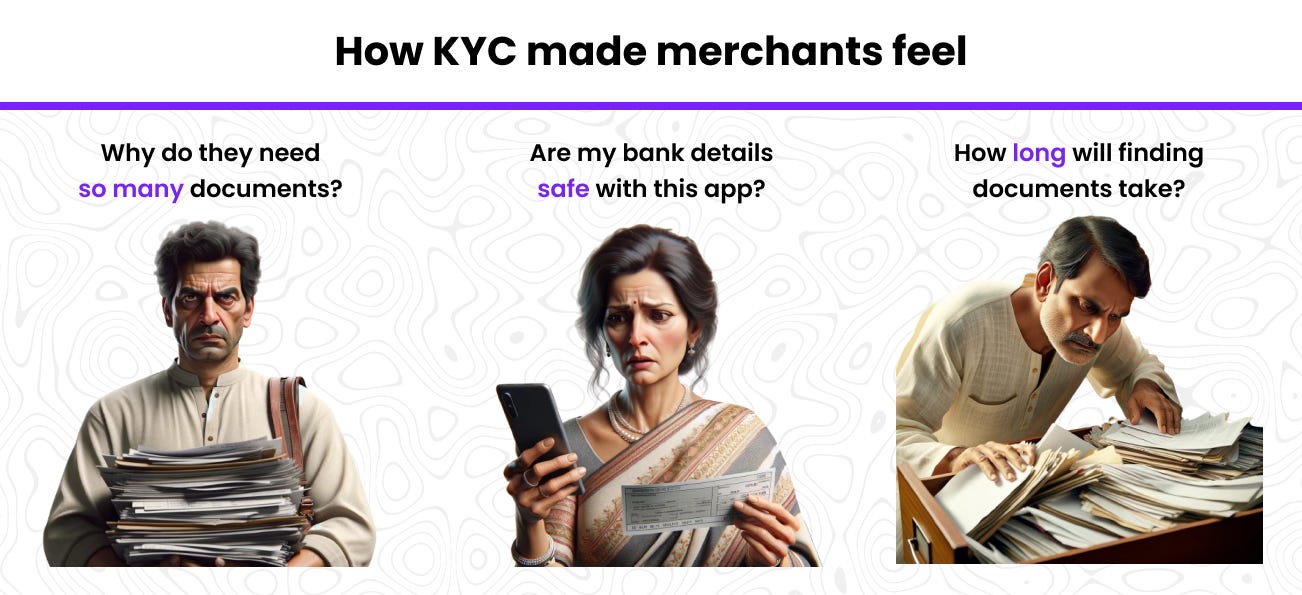

Designing KYC: a bachata feat. Growth and Compliance💃

Similar to Payment Gateways like Razorpay and Cashfree, we had to conduct KYC of merchants on whose behalf we were collecting payments. As seen with Paytm’s run-in with RBI in February 2024, thorough and compliant KYC had always been non-negotiable.

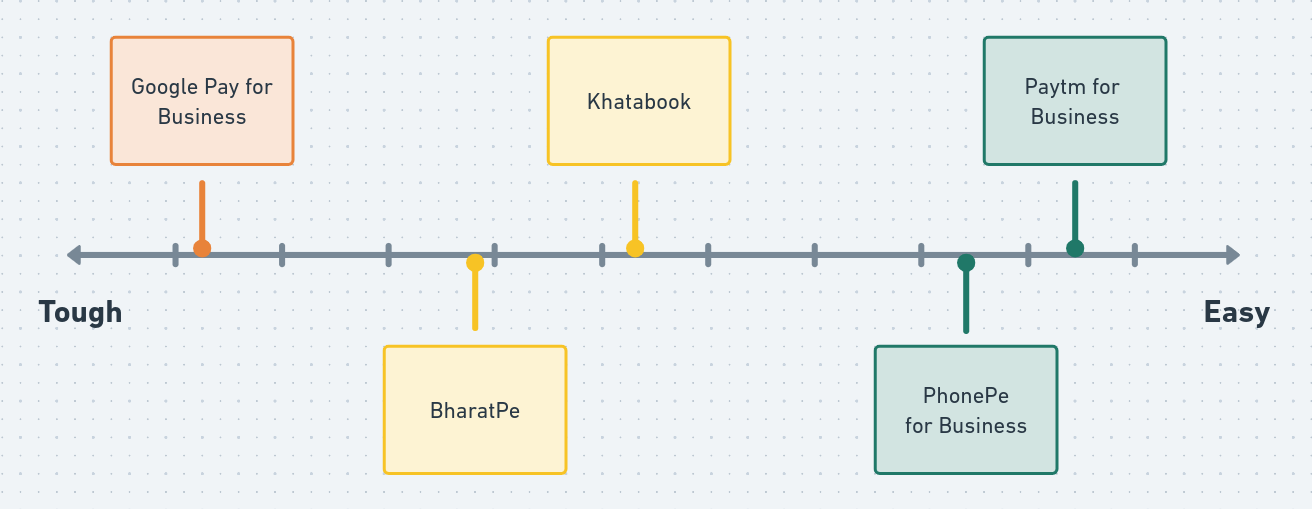

We studied merchant apps of fintech giants like Paytm and PhonePe on parameters such as Time-To-Value, ease of use and rigour of compliance, and tried to understand the rationale behind their design choices.

Paytm and PhonePe prioritised growth, while Google Pay erred on the side of compliance

Based on our survey of existing fintech apps and our understanding of myBillBook merchants, we recognised that a KYC process:

can often prove cumbersome and time-consuming

requires merchants to trust you

is full of friction

We tacked these concerns by:

Tailoring the KYC process to myBillBook’s audience using existing merchant information

Reassuring merchants of safety and robustness at every step to win their trust

Designing the experience such that friction and Time-To-Value were minimised

We built a 2-part document-free KYC that enabled merchants to experience the value of automatic reconciliation with Smart Collect at all 3 stages of KYC:

No KYC (both parts unverified)

Partial KYC (first part verified)

Full KYC (both parts verified)

📈 Within a month of launch, propelled by 2-part document-free KYC and other behavioural nudges in place, we achieved 60% partial KYC and 14% full KYC among myBillBook power users who enabled the feature.

We further improved partial KYC by 17% by offering an easier UPI-powered KYC.

As you may have inferred from this article, our ethos was clear – shipping beats perfection 🏃♂️. We empowered our Payments Ops team 👥 to step in where we had deliberately scoped out certain scenarios or hadn't anticipated edge cases in KYC verification.

While this was a (very) brief summary of our KYC design process, you can read a deep-dive encompassing competitor research, rationale behind design choices and their subsequent metrics, operations processes and interesting episodes about Indian merchants in this detailed article:

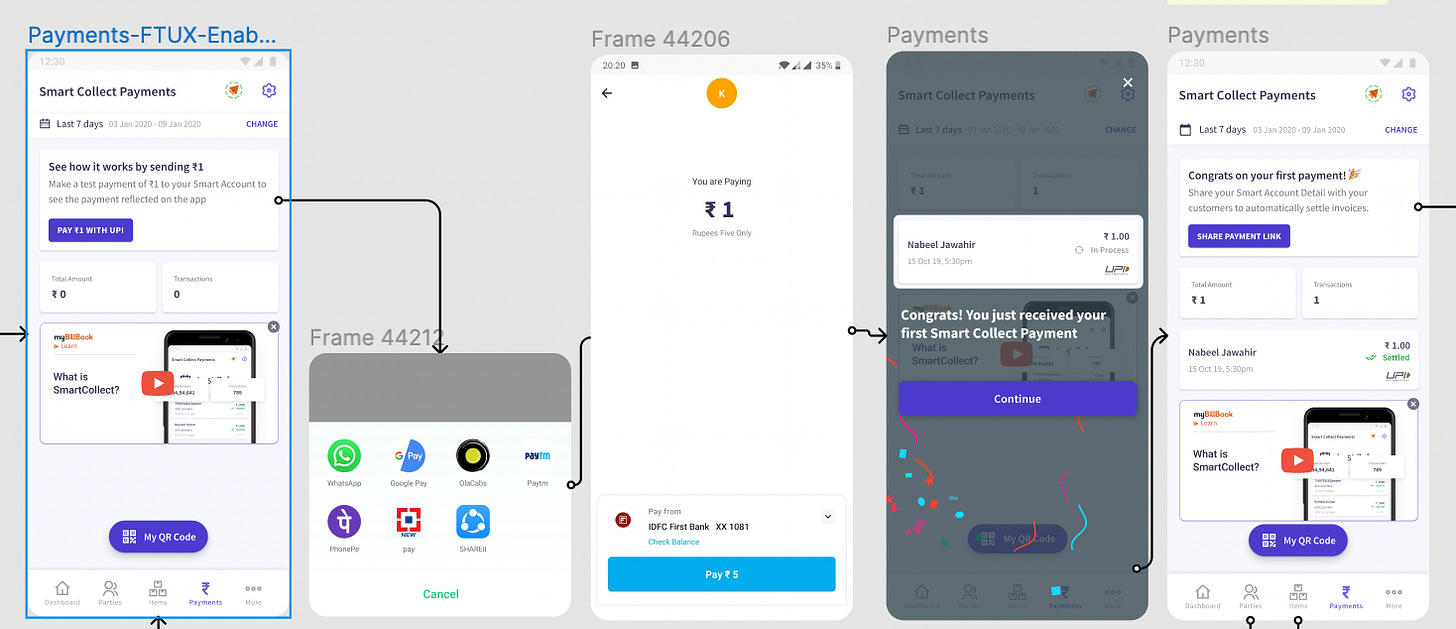

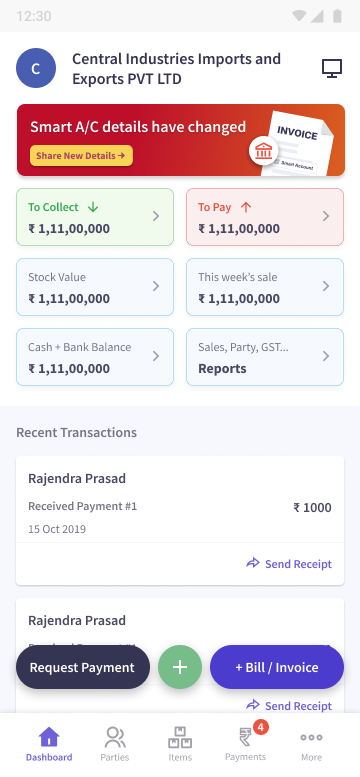

When all was said and done, this was how Smart Collect looked at launch:

Post Launch: A Prelude to Triumph

Is it just us, or does everyone derive their dose of dopamine by constantly looking at charts and numbers after a launch? 😅

There's a certain childlike wonder in watching the line charts, almost as if they're transformed into racing cars on an imaginary track. We set invisible checkpoints, eagerly anticipating each moment they zoom past them. It’s a pulse-racing experience, wrapped in the simplicity of data visualisation.

All our hard work, dedication and a month-long breakneck execution culminated on the night of Oct 28, 2021, when finally the code was pushed and the feature was released to 2000 businesses.

A Ritual of Anticipation and Hope

In the days following the launch, the first action of the morning—before the haze of sleep had fully lifted, with eyes barely open and the remnants of dreams still lingering—was to check the dashboards. This ritual, performed with a mix of excitement and nervous anticipation, became a staple. The last glimpse at night, too, was reserved for these charts. They were our storybook, telling tales of progress, challenge, and triumph, one data point at a time.

The First Glimpse of Success

It wasn’t long before we started to see some validation of the product as our users grappled with this new product and the transformation of their regular billing app into a smarter all-in-one business management tool.

The Inaugural Week: A Promising Start

📈 Right from the get-go, the enthusiasm was palpable:

Over 1,000 users activated the payments feature, eager to explore its potential.

260+ users embraced the innovation, successfully collecting at least one payment through the platform.

A remarkable ₹9.2 lakh was processed, signalling strong initial traction.

30+ users ascended to 'power user' status, each collecting more than five payments—a testament to the feature's utility and ease of use.

Impressively, 4 trailblazers entrusted us with transactions exceeding ₹10,000, showcasing remarkable early trust in our solution.

The First Month: Momentum Builds

📈 The initial spark ignited a fire of activity and adoption:

The total processed soared to ₹21 lakh, doubling down on our early promise.

The ranks of 'power users' swelled to 400+, a clear indicator of the feature's growing indispensability.

An encouraging 300+ users confidently conducted transactions over ₹10,000, further validating the platform's reliability and security.

And so the saga unfolded, marked by milestones as transactions exceeding ₹2 lakhs each effortlessly flowed through our platform. User satisfaction echoed in a flood of glowing reviews. In essence, we witnessed the dawn of a true Product-Market Fit (PMF), as users began to wholeheartedly embrace and adore the product.

Beyond the Numbers: Signs of Product-Market Fit

The early adoption phase was a powerful affirmation of our vision. The rapid embrace of our payments feature, coupled with the tangible benefits it delivered, signalled a likely product-market fit (PMF). It became evident that users weren't just accepting the new feature but starting to love it 🫶.

Beyond Early Wins: Facing the Real Test

While there were clear signs of early PMF however it was still far off from a resounding success. Here’s why:

Unveiling the Challenges

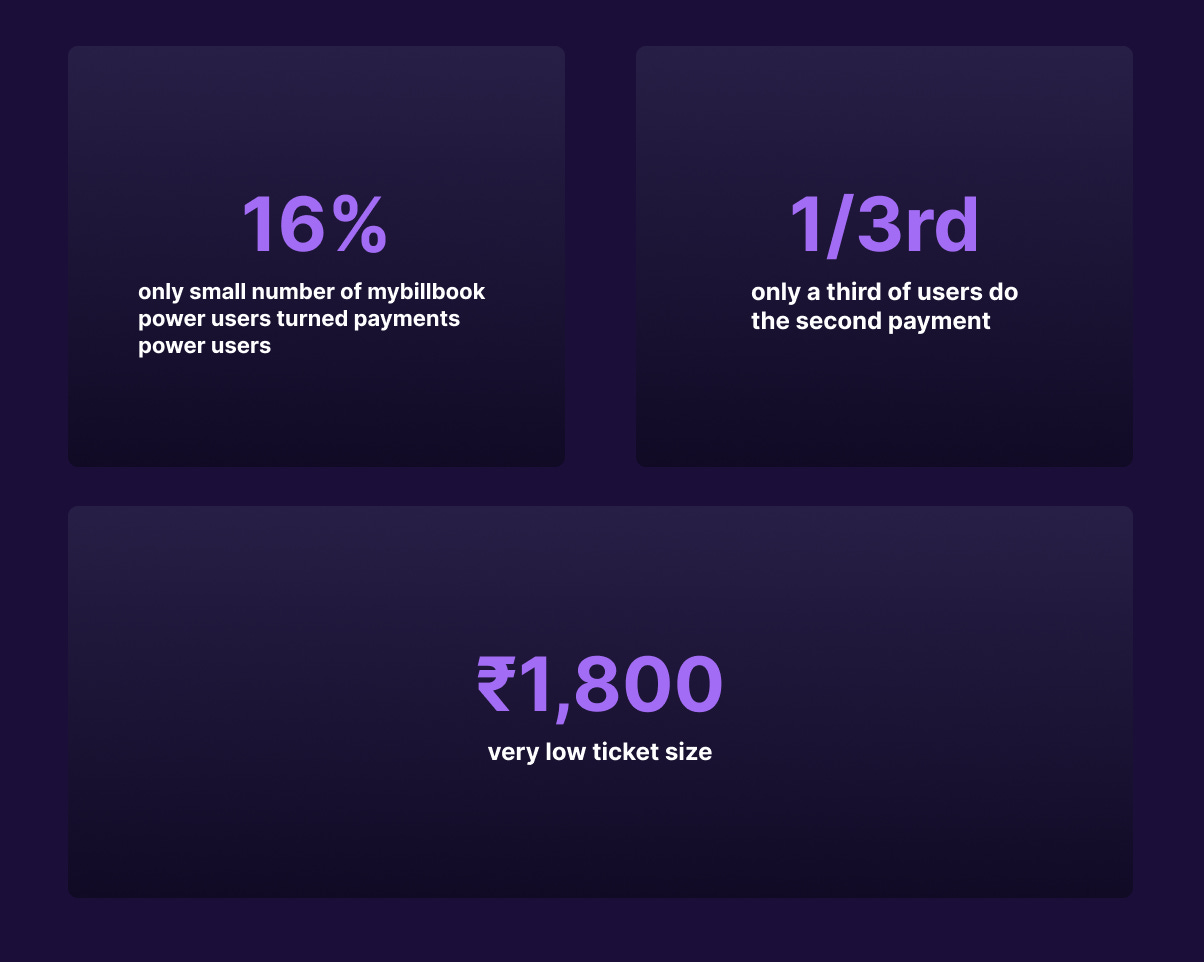

📈 Upon delving into the data, several key insights emerged:

Low Power User Engagement: A mere 16% of myBillBook power users had embraced this new payment feature, indicating significant room for growth and adoption among our most active and influential customer base.

Low Repeat Usage: Only 34% of users who made their first payment ventured to make a second one, highlighting potential hurdles in user experience or perceived value that needed addressing.

Low Ticket Size: The average transaction amount through the payment feature hovered around ₹1,800, starkly lower than the ₹7,200 average of manual payment entries on the platform. This gap underscored the necessity for strategies to encourage higher-value transactions.

High Test Payments Incidence: A substantial 45% of transactions were identified as test payments, involving sums less than ₹10. This phenomenon pointed towards users experimenting with the feature but possibly hesitating to use it for genuine business transactions.

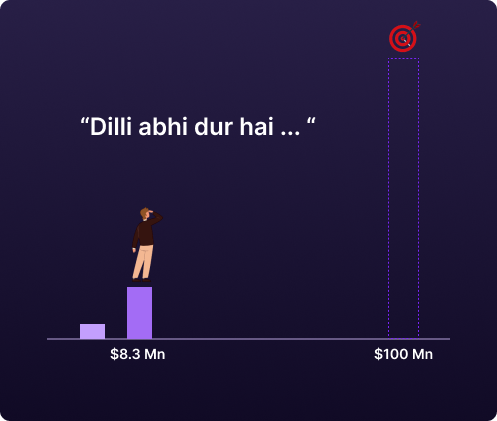

Furthermore, our objective was to process $100Mn worth of transactions within a year, equating to approximately $8.3Mn per month (or ₹66.4 crore). However, at the time, our actual monthly transactions amounted to just over $26,000 (or ₹21 lakh), representing a mere 0.3% of our target! 😱

We again had a steep climb in front of us. This time it was about figuring around the gaps and ironing them out, deploying product smart product strategies to grow. As they say, building a product is one thing, but consistently finding PMF and sustaining growth is a whole new ball game!

Decoding the Strategy: Scaling to $100 Million in Transactions

In a PM interview scenario, it's about choosing between a top-down or bottom-up approach, however in real life, one has to evaluate things from both perspectives. The top-down approach helps you break down your high-level business goals into small milestones that you need to achieve to get to the zenith while you need to take a bottoms-up approach to understand the problems and solve the broken-down milestones.

And that's what we did, our guiding question (from the top down) was simple yet ambitious: "How do we reach $100 million worth of transactions within a year?"

Top-Down: Decoding the Growth Equation

Now doing $100 Mn worth of transactions in a year means we need to do ₹66.4 Cr TPV in a month.

Also,

Further,

💡 This formula laid out our strategic levers:

increasing the number of transacting users

boosting the average number of transactions each user makes, and

raising the average transaction amount

Expanding the User Base

The growth in transacting users hinges on a balanced equation of attracting new users, retaining existing ones, and minimising churn. Key to this balance is enhancing user trust and the perceived value of our feature, ensuring it stands out against alternatives like UPI apps, bank transfers, and cash transactions.

Boosting Transaction Frequency and Value

Two interconnected metrics—average number of transactions per user and retention—emerge as critical to increasing TPV. Both improve as users recognize the product's value and trust its reliability. Encouraging adoption beyond retailers, particularly among businesses dealing in higher-value transactions, can significantly elevate the average transaction amount.

Attracting New Users

User growth is fueled by visibility and perceived value, leading to trial and adoption. Reducing friction in the product discovery and onboarding processes is essential to converting curious onlookers into active users.

💡 To summarize, the key takeaways / goals yielded by the Top-down approach are:

How may we get more users to try 1st payment?

How may we get users who did 1 payment to do the 2nd payment and then do their 5th payment?

How may we get users to collect bank transfer payments?

Now that we've recognized this, our next step was twofold: first, to understand why it wasn't happening, and second, to delve into the behaviours and motivations driving each aspect, and then find solutions to address them.

Here is where the bottom-up approach comes in handy.

Strategic Playbook for Growth: Turning Insights into Action

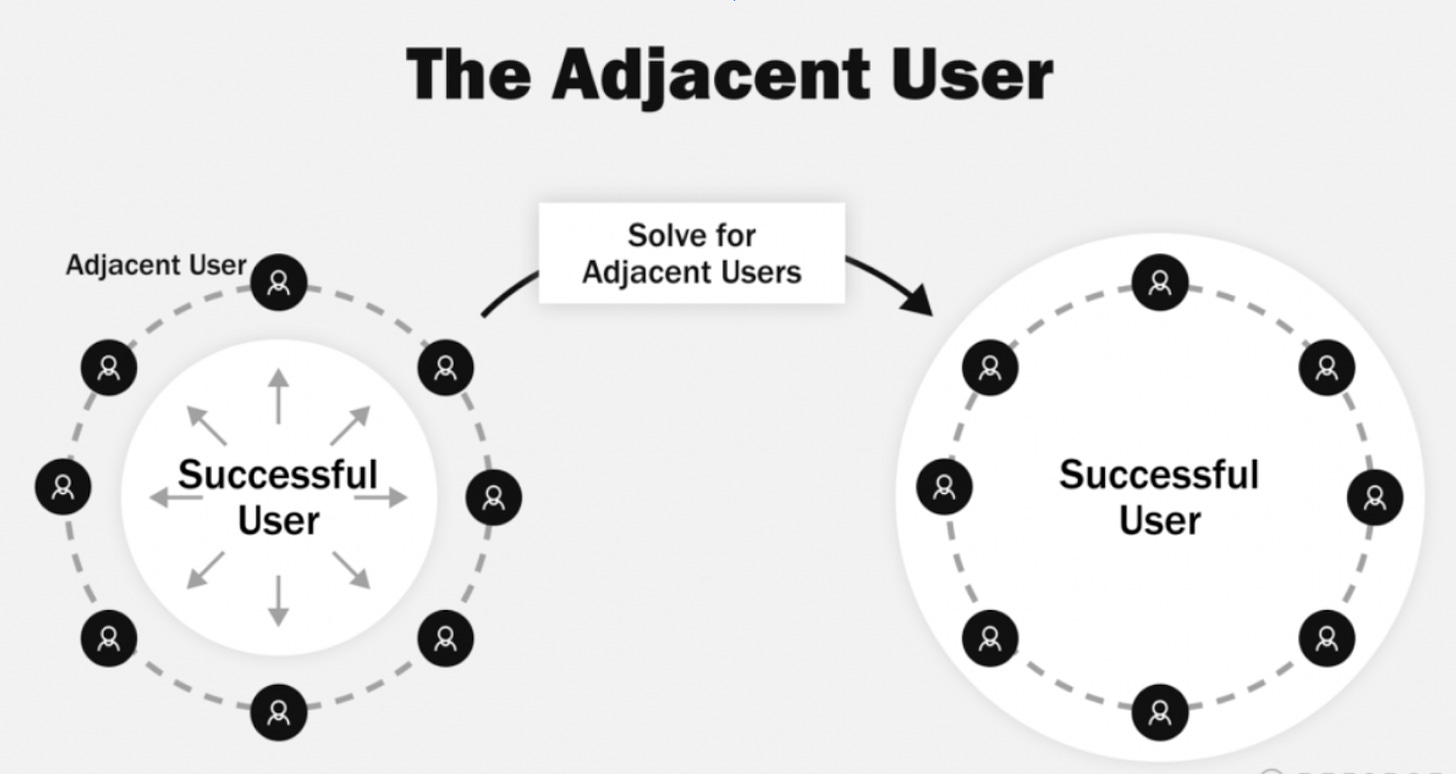

As discussed earlier we had seen some early PMF with some of the users, what is PMF though and is it constant? Those are some really deep questions which we can spare for another article.

For now, what we can agree upon is that PMF is a constant process and it's about getting more and more customers and different kinds to sustain it.

We can think about the interaction between a product and its users as a series of circles. Each circle represents the state of usage that a user is in (for example Power, Core, Casual, Signed Up, Visitor). Each one of these circles has users that are “in orbit” around it. These users have an equal or greater chance of drifting off into space rather than crossing the threshold to the next state. Something is preventing them from getting over the hump and transitioning into the next state. These are your adjacent users and the goal is to identify who they are and understand their reasons for struggling to adopt. As you solve for them, you push the edge of the circle out to capture more of that audience and grow.

Now there could be two ways to do this:

Mission Alpha: Understand what got the current power users to use the product,

Identify the user persona and nuances about these users and try to find more such users and activate them

Identify what they like about the product. What worked for them? And try to make the adjacent users realize the same value.

Mission Beta: Identify the adjacent users or potential power users (in our case: use the app well and manually record digital payment against their invoices) and try to understand what they didn’t like about the product and solve that.

And that’s exactly what we did, we conducted user research and collected insights from these two audiences.

Mission Alpha: Finding other power users

💡 Insights from Power Users:

Most power users tried a small ₹1 or ₹10 transaction to their account to gain trust before sharing these payment details with their end customers.

Over 70% of these users used some other UPI apps like Gpay, PhonePe, BharatPe etc.

Almost 80% of the power users received more than 30 payments a month, over 50% received more than 90 payments a month and over 30% received 150+ payments in a month.

The selling points for these power users were Automatic Reconciliation with their bills, QR code and the sharing of payment links with their customers.

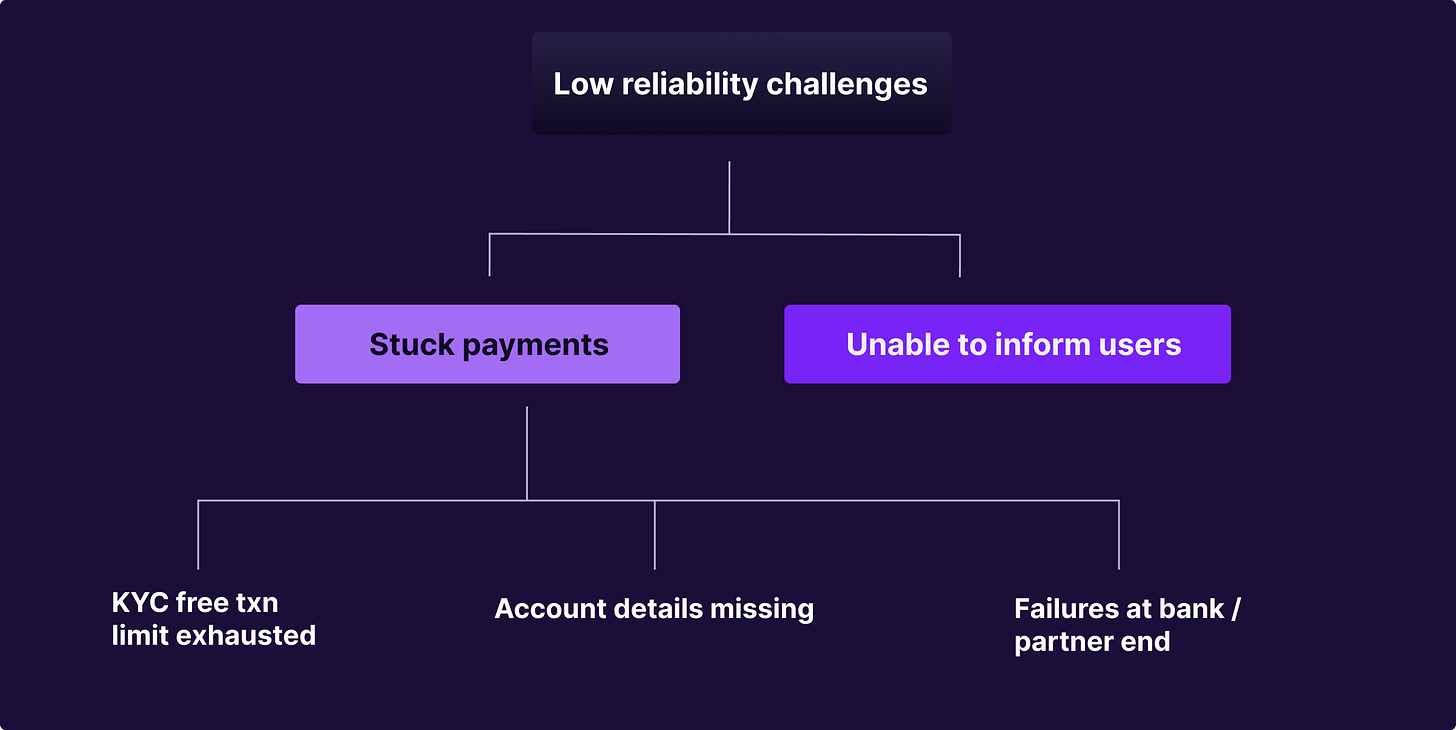

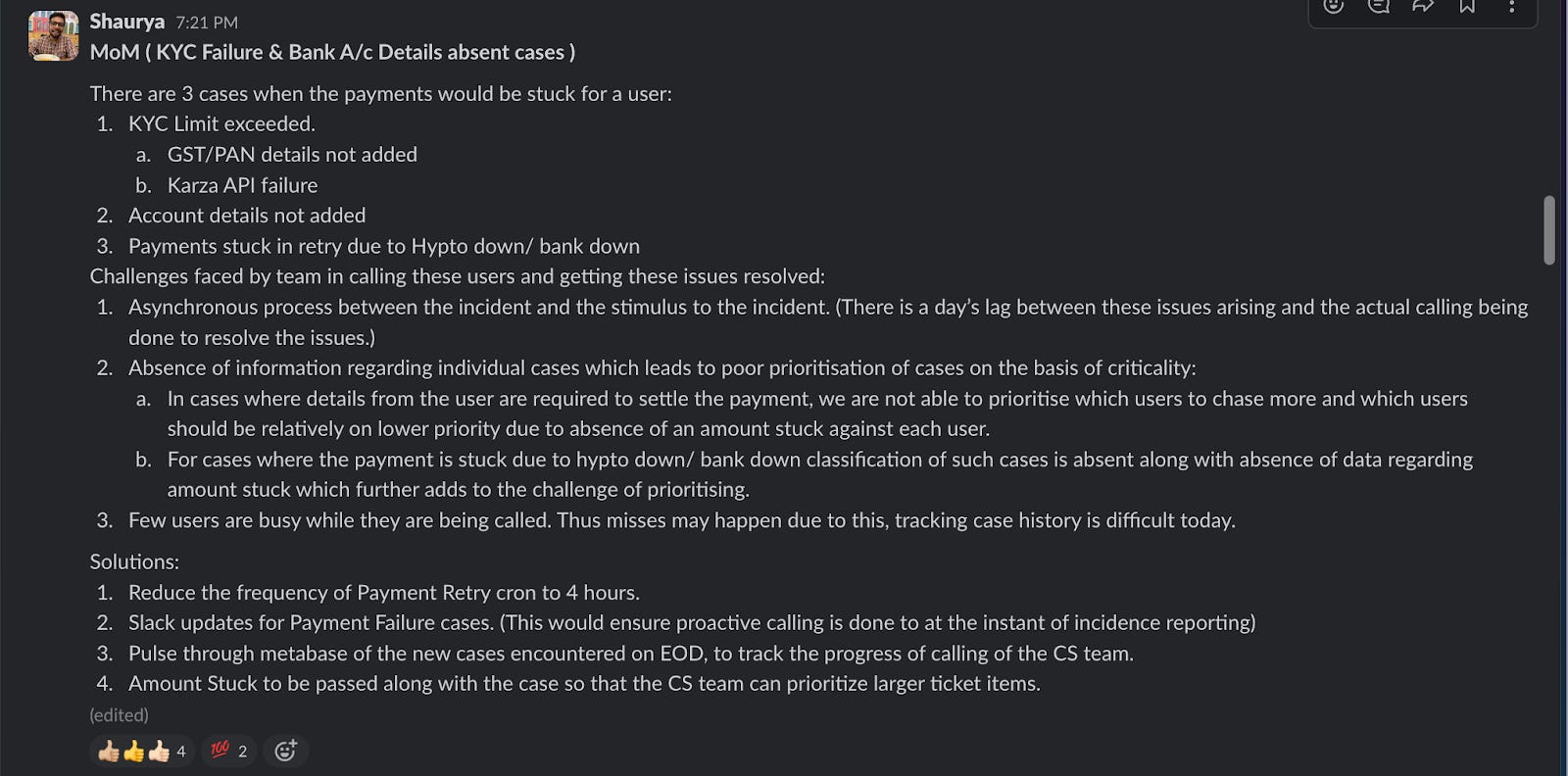

One of the major concerns of these users was the reliability of payments. A few of their payments got stuck for a few hours which made them uncomfortable.

As soon as we had these insights, the plan of action was clear:

Plan of Action

Targeted Feature Rollout

Identify Users: Focus on users within the app who prefer instant settlements, have used UPI for manual payments, and record high monthly payment frequencies.

Feature Introduction: Introduce the payments feature to this cohort with focused awareness campaigns, encouraging trial through their first payment.

Building Trust

Implement a "reverse penny drop" feature, allowing users to conduct a small transaction to their account as a trust-building measure.

What is the Reverse Penny Drop?

Reverse penny drop is a bank account verification method. Unlike traditional penny drop verification, where a small amount (often one rupee) is deposited into an account to check its validity, reverse penny drop involves the customer making a ₹1 payment to a specific Virtual Payment Address (VPA) registered for the organization. After the payment is made, the organization can extract the customer's bank account information from the transaction and use it for verification purposes

Enhancing Onboarding:

Incorporate the identified selling points into the onboarding process, using coach marks and targeted messaging to highlight these features.

Addressing Reliability

Finally, we needed to address the reliability challenge, which was not that hard to do and here’s a sneak peek of what we did:

Impact of Strategic Changes

By December, these strategic adjustments resulted in a significant increase in user engagement and transaction volume, reaching ₹7 Cr/month in processed payments. This growth trajectory underscores the effectiveness of combining deep user insights with targeted feature enhancements and communication strategies to foster trust, highlight value, and encourage adoption.

While the power users approach was fairly easy and it led us to ₹7 Cr/ month TPV, however, we were still nowhere home on our road to ₹60 Cr / month TPV. And the journey ahead was trickier with no easy answers.

Mission Beta: Solving for underserved users

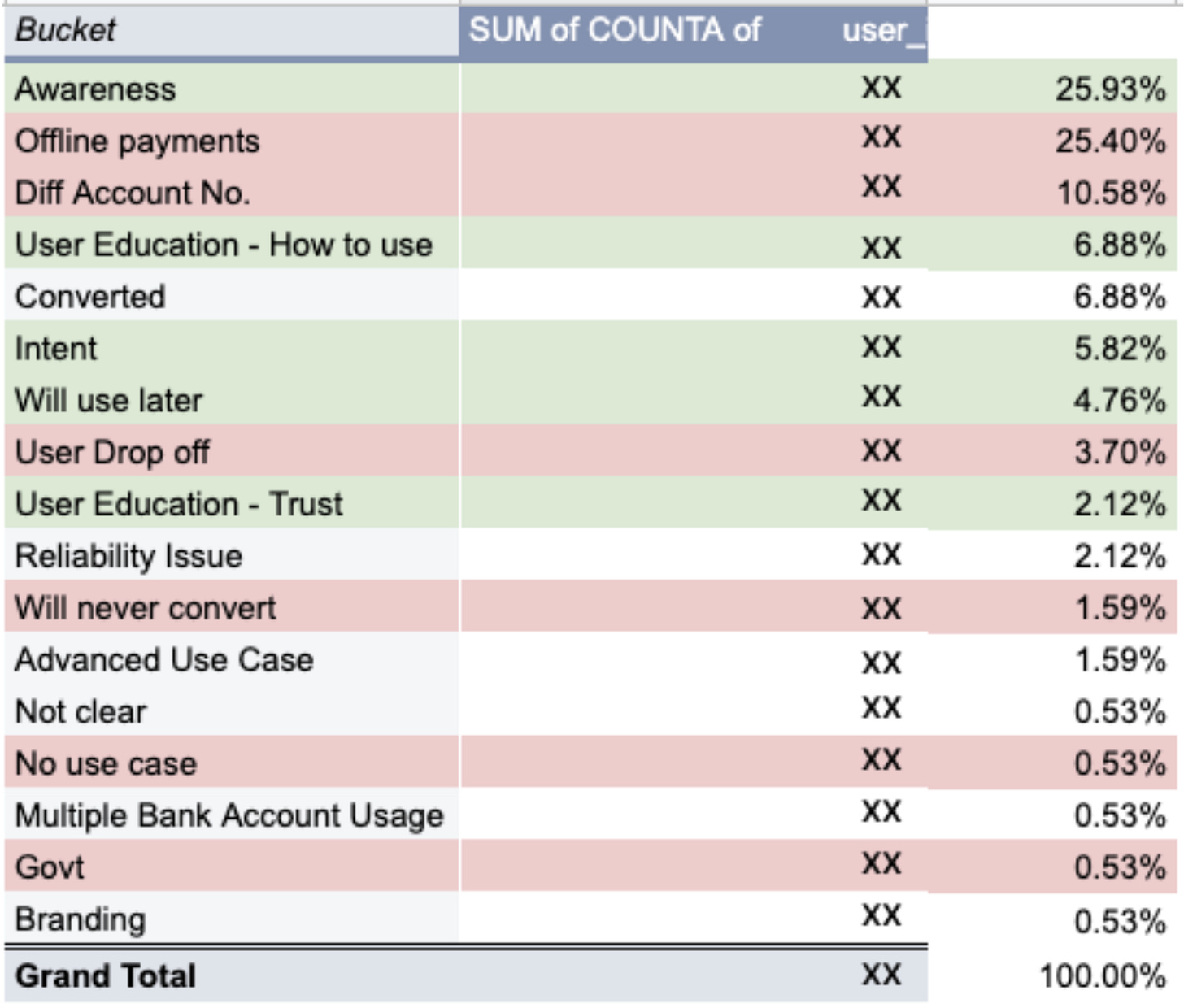

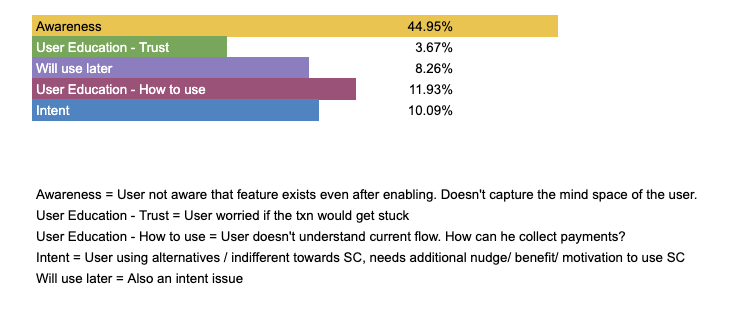

Continuing with our approach, next we talked to our ‘Potential Power Users’ and the insights yielded a long tail of issues summarised in the table below:

It's crucial to acknowledge that not all problems can be solved. There will inevitably be users who are unwilling or extremely resistant to adopting your product. In such cases, it's prudent to identify these users and refrain from attempting to address their needs until all potential power users have been thoroughly addressed.

Likewise, in the table above, we recognized that the issues highlighted in red pertain to users whose behaviour is difficult to disrupt. Consequently, we opted to prioritize addressing only the problems marked in green during this iteration.

Once we summarized the results of the green issues in the table we got the following things we need to solve in order:

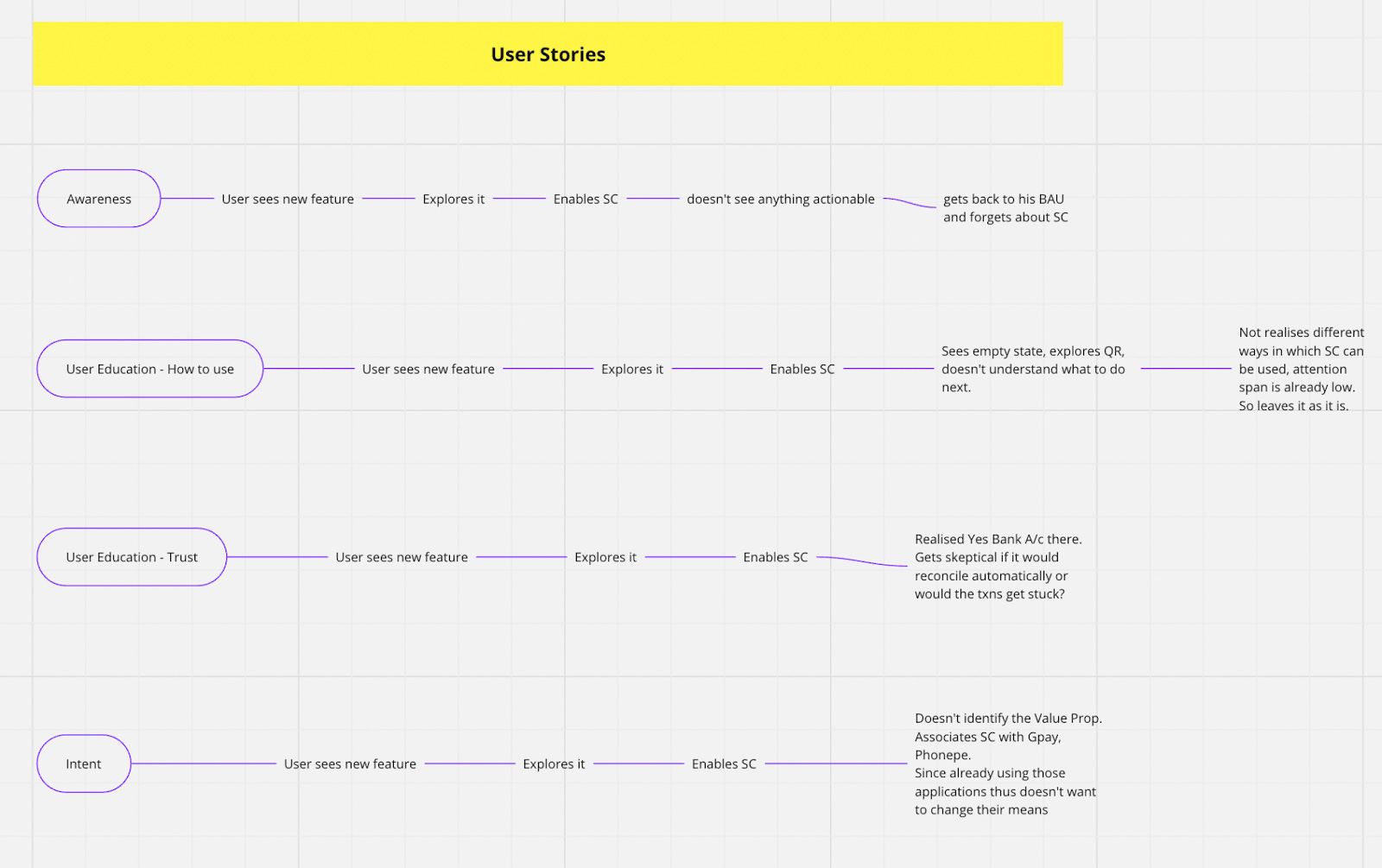

Now if you were to visualize how this might be affecting users you can imagine the following user stories:

Up to this point, we've grasped the challenges encountered by potential power users and what would motivate them to activate the product. However, our journey doesn't end there. We still need to determine what would encourage users to sustain their usage of the product, particularly in terms of users who make their 1st payment and how to incentivize them to engage in subsequent transactions.

Would you have approached this challenge differently? Tell us how

The Final Frontier: Piecing it together

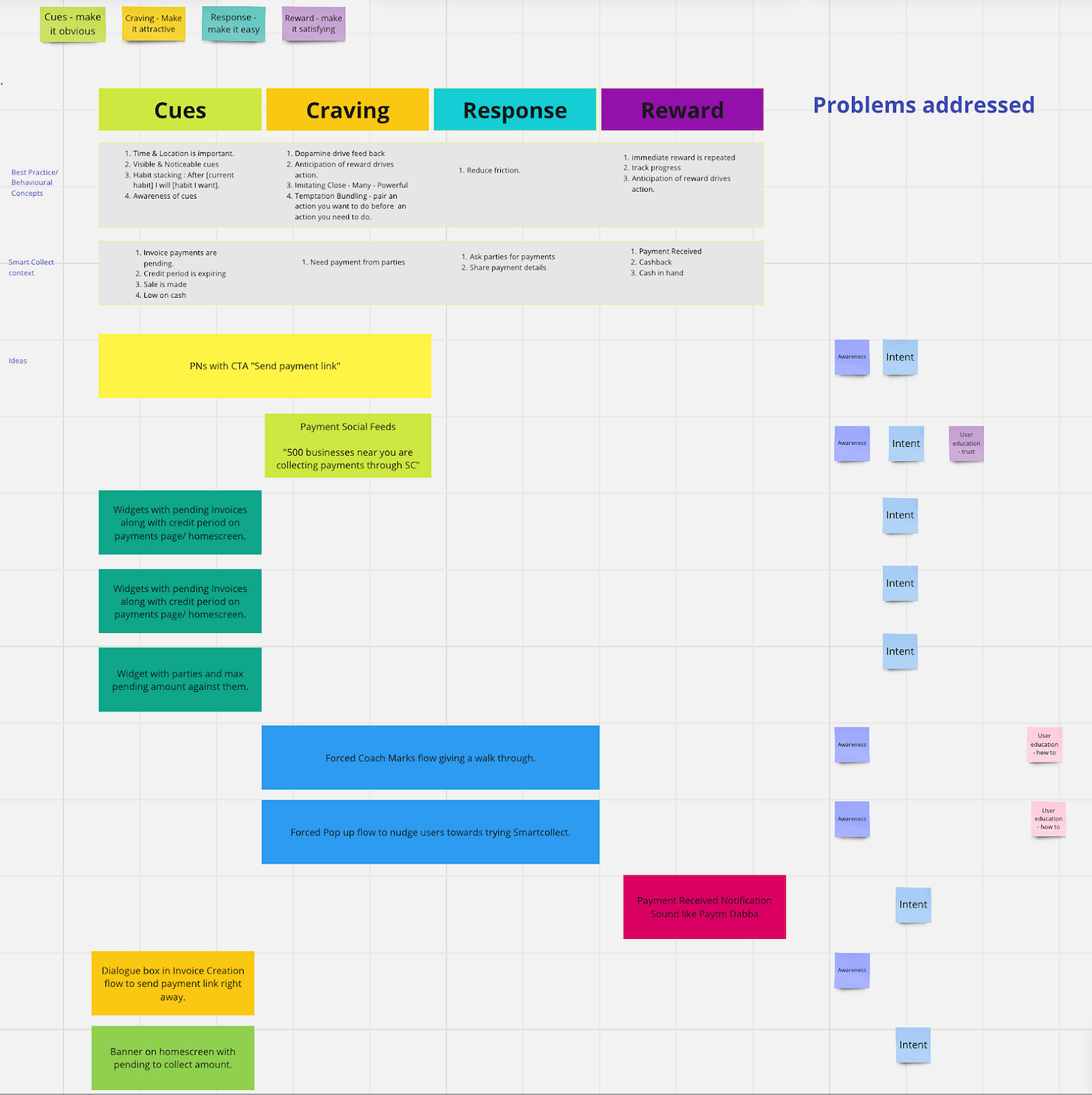

We needed a comprehensive strategy to address both activation and adoption problems at once. To solve this we took a page out of Atomic Habit.

We thought the “Adoption Problem (users trying 1-2 payments or enabling Smart Collect but not using extensively) could also be looked at as a Habit Problem” getting inspired by this quote by James Clear:

“Outcomes are a lagging measure of Behaviour & Habits”

The habit we wanted to make: Users using Smart Collect as their default mode of payment.

Forming a habit one payment at a time

We studied the habit loop and started correlating it with our product. It has to start with a cue, we would need to generate a craving, the user would take a response and then we should reward them.

From strategy to execution, we were transforming habits

Once we had this framework in place we would earmark initiatives against each step and would start executing.

Cues - making it obvious

The idea here was to remind the user about the presence of a payment product wherever they go. Deeply integrate and place elements of payments in their usual workflows. Initiative like:

Placing entry points to collect payments in their ledgers, party (our user’s customers) page, invoice screen etc.

As soon as the user creates an invoice we show them an option to collect payment right away using QR or sending a payment link.

Craving - making it attractive

This was all about showing users how easy it was, showing them the upside and using their inherent motivation to our advantage. Initiatives like:

Showing elements like “You have to collect ₹1,00,000 from Ajey Enterprise this week, collect it now using Smart Collect” to entice users to get instant payments.

Providing Social Validations about other businesses optimising their workflow by using Smart Collect. E.g “50 businesses near you collected their pending payment via Smart Collect”

Response - making it easy

We optimised the flows and made it easy

For businesses to collect payments

For customers of this business to make payments

Here we took initiatives like:

Automatically sending payment requests on WhatsApp with payment links.

Revamping the party (our user’s customer) links to be more payment-focused. Earlier the links sent out were used to show the invoice to the payee, the payee had to find the payment details and then make the payment. We brought payments to the forefront of this interaction making it easier for the payee to make a payment to myBillBook user.

Reward - making it satisfying

Giving users instant gratification and payment alerts using a Sound Alert (similar to Paytm Soundbox) was much appreciated by our customers.

Pacifying the users with elements that would show their latest payment collection.

Automatically settle the invoices of the users, settling the open ledgers by identifying the corresponding payments.

Okay so we have solved most of the issues until now the only pieces to be put together are - “How do you get users to process higher transaction amounts?”, and “How do you get users to do bank transfers as well with you?”.

The final piece to the puzzle - Cashbacks!

Until now you would have been wondering “Where are the Cashbacks?”, “ Why aren’t you rewarding your users?” 😅

And you are right, until now most payment products have gained traction by giving out cashback and monetary rewards to the users for using it. Be it Google Pay giving flat Rs 50 for inviting a friend or the standard scratch cards in Paytm, Phonepe and many other products. Cashbacks have been the staple growth hacking method. And we even introduced a rewards program to reward the right behaviour.

However, cashbacks in our case were slightly tricky. See, we are dealing with businesses, if a business is collecting a payment of ₹1L, ₹15L, ₹50k getting a cashback of ₹10, ₹50 might not be rewarding for them. That’s where we had to design our reward program a little differently. How we designed our rewards program calls for a whole article of its own 💀 so will skip that for now. But subscribe now to not miss it!

But let us tell you that we went one step further.

Counterparty Rewards

One thing that we want you to appreciate is that our payments product is a 3-player product.

myBillBook who is handling the payment for their users.

myBillBook’s users who want to collect payments from their customers (call them counterparty).

Counterparty itself, who are paying for the services/ goods availed from myBillBook users.

What we also realised during this period was that for our payment product to grow it was important for myBillBook users to adopt the product as much as it was important for counterparties as well to adopt the product

If a counterparty refuses to pay to a myBillBook user via our payment method then the myBillBook user is helpless and has to collect payment via an alternative route.

💡 Furthermore, most counterparties would have already added myBillBook users as their beneficiary in their banking apps (as they already have a business relationship), and now to pay a new bank account (i.e. the Virtual Accounts that we created) they would have to add a new beneficiary which is a huge friction point for the counterparties. This is specifically true for B2B businesses.

So we had to reward the counterparties appropriately for taking this pain and adopting a new product. This is why we also launched ‘Counterparty Rewards’ where we would also reward the counterparties for making a payment to myBillBook users via Smart Collect.

We did all this while keeping a guardrail of the following metric:

📈 We had optimised our TPV/ Burn ratio to reach ₹650, which meant that by spending ₹1 as cashback on the user we were able to get a transaction of ₹650 by the user.

The payoff

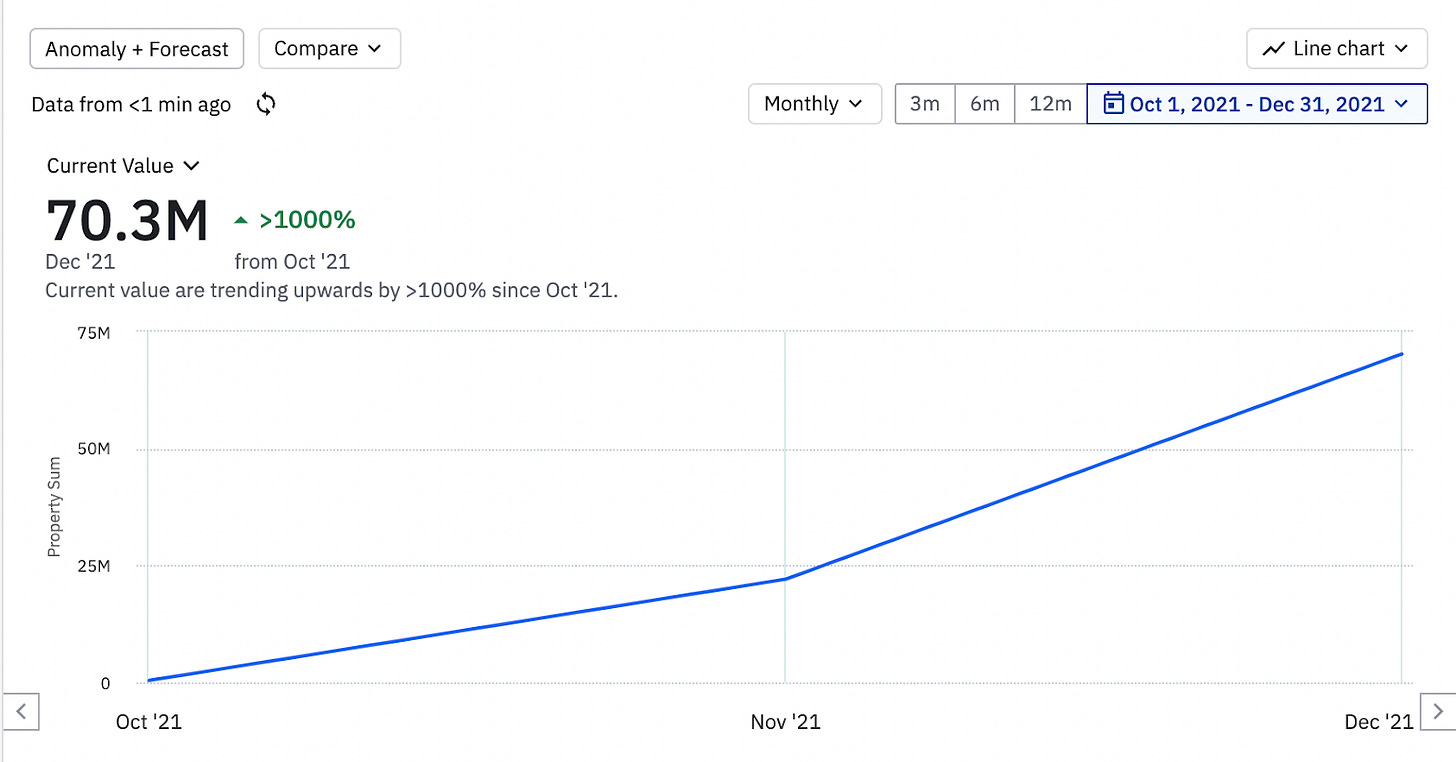

📈 All of this culminated in a tangible success. Here’s what we finally achieved.

Our Total Payment Volume grew by 100x within 6 months.

By the end, we were processing around ₹40 Cr/month (very close to our target ₹66 Cr)

Bank payments contributed to 80% of the share by volume, a vast leap from initial 12%.

The average transaction amount had skyrocketed to ₹4200 from a lowly ₹1800.

97% of payments were settled within 20 minutes and 99.59% of payments were successful in the first attempt

Here’s the ever-rising chart of our TPV which still gives us goosebumps when we think about it.

Fraud: every payment company’s nightmare 💳 🚫

By becoming a tech-enabled intermediary between merchants and customers, and saving multiple man-hours in reconciliation for merchants, myBillBook found itself bearing the brunt of fraudsters using Smart Collect.

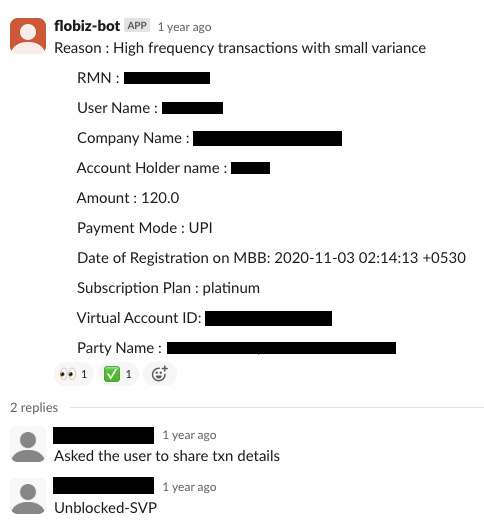

💡 Fighting fraud was a multi-dimensional problem. We had to minimise:

Fraudsters onboarded

Victims per fraudster

Days a fraudster was active

Time to verify and unblock incorrectly blocked merchants

We solved these problems with the combined help of an anti-fraud rule engine and a vigilant Payments Ops team. This is what our process looked like:

Hypothesize how fraudsters use Smart Collect based on our conversations with victims and secondary research

Formulate heuristics (by writing SQL queries and making product analytics cohorts) to identify merchants who exhibit such behaviour

Manually evaluate how many of these merchants are fraudulent (often involving phone calls to merchants)

If the precision of the heuristic is high enough, implement and deploy these rules on our anti-fraud engine to block settlements for such merchants

As we got down to business, we quickly realised that suspicion isn’t black or white, it’s grey. So we assigned 4 Levels of Suspicion to myBillBook users (merchants):

We blocked Level 1 and 2 merchants the moment their transaction fell in the gambit of our anti-fraud rule engine. We offered a second chance to Level 1 merchants, by empowering our Operations team to manually review their cases.

We came across all varieties of human and tech deception, from social engineering scams on OLX to phishing pages promising rewards.

📈 With multiple teams working hand-in-hand, to exhaustively cover all aspects of the problem, through multiple instances of learning and executing on the go, we were able to:

limit fraud volume to < 0.03% of monthly TPV

reduce time to spot and block fraudsters to 4 hours (75th %ile)

reduce time to verify and unblock incorrectly blocked fraudsters to 80 minutes (50th %ile)

improve anti-fraud engine’s recall to 92% and precision to 64% (we prioritised recall over precision)

While this was a (very) brief summary of the murky world of fighting fraud, you can read a deep-dive full of data and human intuition-enabled investigative work in this detailed article:

Conclusion

Thank you for sticking with us through this story! It's been a bit of a long read, but since you're still here, we hope it means you've found something interesting and perhaps picked up a few insights along the way.

So, you've seen the whole journey now—why we started Smart Collect, the thought process behind our design choices, diving into virtual accounts, setting up our KYC module, overcoming adoption challenges, fighting off fraud, and ultimately boosting our payment volume by a whopping 100 times!

But here comes the tough bit to share. After all the hard work and success in creating a payment solution that small businesses loved and relied on, we had to say goodbye to it. 💔

It's a bit of a heartbreaker, isn't it?

The main reason? It boils down to the RBI's PAPG guidelines (Payment Aggregator and Payment Gateway).

Firstly, our payment service partner, Hypto, couldn't get a PAPG license. This meant we had to migrate millions of virtual accounts over to Razorpay, who managed to secure the license early on. Imagine trying to move mountains in just 12 days! Our backend team was on a marathon, and our merchants and their customers felt the pinch. We did everything we could to ease the transition, keeping everyone in the loop every step of the way.

Then, just when we thought we were in the clear, subsequent clarifications in PAPG guidelines further complicated our situation by restricting our ability to onboard merchants directly, a process now mandated to be handled by the licensed PAPG entity. Although we considered adapting our payment infrastructure to remain compliant, the potential compromise on user experience, alongside challenges related to KYC processes, support, and settlement times, guided our decision to sunset it :(.

Moreover, the market landscape has shifted dramatically since Smart Collect's inception in 2021. The transition from a zero-interest-rate policy (ZIRP) era, characterized by a 'growth at all cost' mindset, to a market emphasizing profitability and sustainable growth, rendered our original model unsustainable without charging merchants.

Looking Ahead

Despite this setback, we remain optimistic about the future of payments within myBillBook. The evolving fintech landscape continues to present new opportunities for innovation, particularly in areas like Connected Banking and Account Aggregator. We're committed to exploring these avenues, intending to introduce new, value-driven payment solutions that build on the legacy of Smart Collect.

Stay tuned, and thanks for being a part of our journey. Here's to more adventures together with PMF! 🌟🥂

Don't miss out on the next parts of this series! Subscribe now to continue exploring the intricacies of:

Designing KYC: a bachata feat. Growth and Compliance (part 2 of this article)

Fighting Payment Frauds as a Fintech Startup 🕵️ (part 3 of this article)

How to design a Rewards Program (part 4 of this article, yet to be published)

This is such a comprehensive read. Inspires me to get back to the startup world again. What a wonderful journey you have had. Kudos to you!

Its a great read, has to come from someone who was very close to being what was built, why and how. Sad to know about the sunset piece however there are tonnes of PM learning out there for anyone to read and learn.